DEF 14A: Definitive proxy statements

Published on January 16, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

__________________

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant

to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

__________________

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

¨ |

Preliminary Proxy Statement |

|

¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

x |

Definitive Proxy Statement |

|

¨ |

Definitive Additional Materials |

|

¨ |

Soliciting Material Pursuant to §240.14a-12 |

INPIXON

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

¨ |

No fee required. |

|

|

|

|

|

|

x |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

|

|

1. |

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

2. |

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

3. |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

4. |

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

5. |

Total fee paid: |

|

|

|

|

|

|

|

|

|

¨ |

Fee paid previously with preliminary materials: |

|

|

|

|

|

|

¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

|

|

|

|

|

|

|

1. |

Amount previously paid: |

|

|

|

|

|

|

2. |

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

3. |

Filing Party: |

|

|

|

|

|

|

4. |

Date Filed: |

|

|

|

|

2479 E. Bayshore Road, Suite 195

Palo Alto, CA 94303

SPECIAL MEETING OF STOCKHOLDERS

To be Held on February 2, 2018

Dear Stockholder:

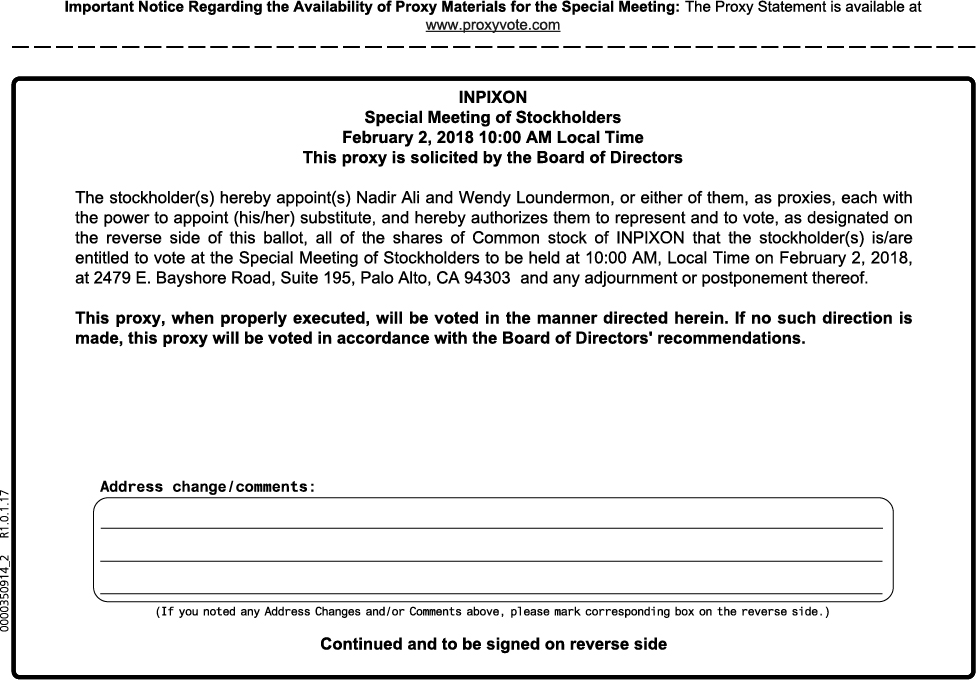

You are hereby invited to attend a Special Meeting of Stockholders of Inpixon (the “Company”) on February 2, 2018, which will be held at 2479 E. Bayshore Road, Suite 195, Palo Alto, CA 94303 at 10:00 a.m., local time (the “Special Meeting”). Enclosed with this letter are your Notice of Special Meeting of Stockholders, Proxy Statement and proxy voting card. The Proxy Statement included with this notice discusses each of our proposals to be considered at the Special Meeting.

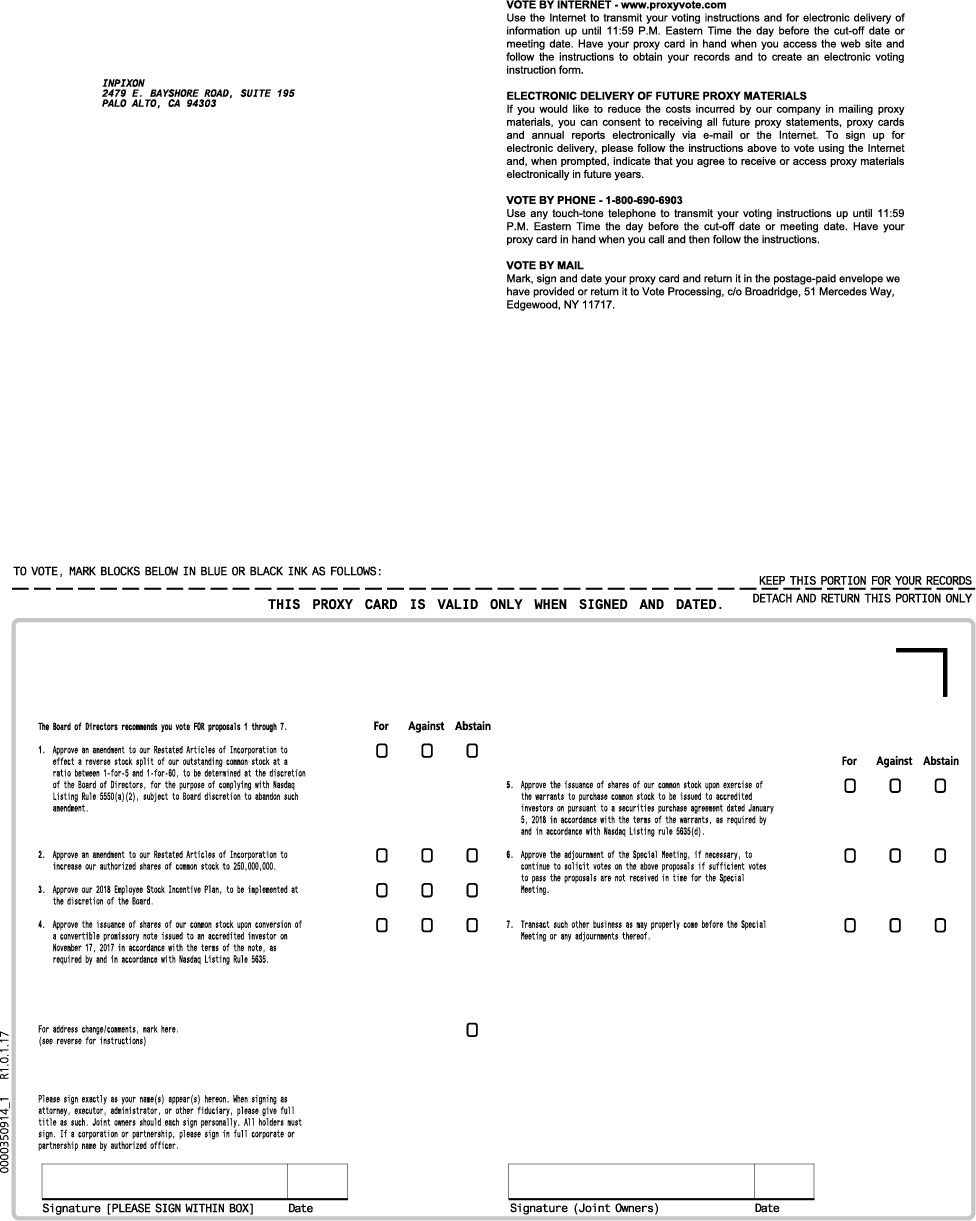

At the Special Meeting, you will be asked to: (1) approve an amendment to our Restated Articles of Incorporation to effect a reverse stock split of our outstanding common stock at a ratio between 1-for-5 and 1-for-60, to be determined at the discretion of the Company’s Board of Directors (the “Board”), for the purpose of complying with Nasdaq Listing Rule 5550(a)(2), subject to the Board’s discretion to abandon such amendment; (2)approve an amendment to our Restated Articles of Incorporation to increase the number of our authorized shares of common stock from 50,000,000 to 250,000,000; (3) approve our 2018 Employee Stock Incentive Plan, to be implemented at the discretion of the Board; (4) approve the issuance of shares of our common stock upon conversion of a convertible promissory note (the “Note”) issued to an accredited investor on November 17, 2017 in accordance with the terms of the Note, as required by and in accordance with Nasdaq Listing Rule 5635; (5) approve the issuance of shares of our common stock upon exercise of the warrants to purchase common stock (the “Warrants”) to be issued to accredited investors pursuant to a securities purchase agreement, dated January 5, 2018, in accordance with the terms of the Warrants, as required by and in accordance with Nasdaq Listing rule 5635(d); (6) approve the adjournment of the Special Meeting, if necessary, to continue to solicit votes on the above proposals if sufficient votes to pass the proposals are not received in time for the Special Meeting; and (7) transact such other business as may properly come before the Special Meeting or any adjournments thereof.

We previously asked our stockholders to approve proposals substantially similar to proposals 1 and 2 above at our annual meeting held on December 8, 2017 (the “Annual Meeting”). Although at least a majority of the votes cast at the Annual Meeting voted in favor of those similar proposals, under Nevada law the required vote is a majority of the outstanding shares our common stock entitled to vote. As a result, we are asking for approval of proposals 1 and 2 above at the Special Meeting.

Our Board has fixed the close of business on January 8, 2018 as the record date for determining the stockholders entitled to notice of and to vote at the Special Meeting and any adjournment and postponements thereof.

I hope that you attend the Special Meeting in person. Whether or not you plan to be with us, please vote over the Internet, by telephone or complete, sign, date, and return your voting card promptly in the enclosed envelope.

|

|

|

Sincerely, |

|

|

|

|

|

|

|

|

|

|

|

Nadir Ali |

|

|

|

Chief Executive Officer |

Palo Alto, California

January 16, 2018

2479 E. Bayshore Road, Suite 195

Palo Alto, CA 94303

Notice of Special Meeting of Stockholders

to be held February 2, 2018

To the Stockholders of Inpixon:

The Special Meeting of Stockholders will be held at 2479 E. Bayshore Road, Suite 195, Palo Alto, CA 94303 at 10:00 a.m., local time, on February 2, 2018. During the Special Meeting, stockholders will be asked to:

(1) approve an amendment to our Restated Articles of Incorporation, as amended (the “Articles of Incorporation”), to effect a reverse stock split of our outstanding common stock at a ratio between 1-for-5 and 1-for-60, to be determined at the discretion of the Company’s Board of Directors (the “Board”), for the purpose of complying with Nasdaq Listing Rule 5550(a)(2), subject to the Board’s discretion to abandon such amendment;

(2) approve an amendment to our Articles of Incorporation to increase the number of our authorized shares of common stock from 50,000,000 to 250,000,000;

(3) approve our 2018 Employee Stock Incentive Plan, to be implemented at the discretion of the Board;

(4) approve the issuance of shares of our common stock upon conversion of a convertible promissory note (the “Note”) issued to an accredited investor on November 17, 2017 in accordance with the terms of the Note, as required by and in accordance with Nasdaq Listing Rule 5635;

(5) approve the issuance of shares of our common stock upon exercise of the warrants to purchase common stock (the “Warrants”) to be issued to accredited investors pursuant to a securities purchase agreement, dated January 5, 2018, in accordance with the terms of the Warrants, as required by and in accordance with Nasdaq Listing rule 5635(d);

(6) approve the adjournment of the Special Meeting, if necessary, to continue to solicit votes on the above proposals if sufficient votes to pass the proposals are not received in time for the Special Meeting; and

(7) transact such other business as may properly come before the Special Meeting or any adjournments thereof.

We previously asked our stockholders to approve proposals substantially similar to proposals 1 and 2 above at our annual meeting held on December 8, 2017 (the “Annual Meeting”). Although at least a majority of the votes cast at the Annual Meeting voted in favor of those similar proposals, under Nevada law the required vote is a majority of the outstanding shares our common stock entitled to vote. As a result, in addition to the other proposals included herein, we are asking for approval of proposals 1 and 2 above at the Special Meeting.

If you are a stockholder as of January 8, 2018, you may vote at the meeting. The date of mailing this Notice of Meeting and Proxy Statement is on or about January 16, 2018.

BY ORDER OF THE BOARD OF DIRECTORS,

|

|

|

|

Wendy Loundermon |

|

|

Secretary

January 16, 2018

PROXY STATEMENT

This Proxy Statement and the accompanying proxy card are first being mailed, beginning on or about January 16, 2018, to owners of shares of common stock of Inpixon (which may be referred to in this Proxy Statement as “we,” “us,” “Inpixon,” or the “Company”) in connection with the solicitation of proxies by our Board of Directors (the “Board”) for a special meeting of stockholders to be held on February 2, 2018 at 10:00 a.m., local time, at 2479 E. Bayshore Road, Suite 195, Palo Alto, CA 94303 (referred to as the “Special Meeting”). This proxy procedure permits all stockholders, many of whom are unable to attend the Special Meeting, to vote their shares of common stock at the Special Meeting. Our Board encourages you to read this document thoroughly and to take this opportunity to vote on the matters to be decided at the Special Meeting.

CONTENTS

|

|

|

Page |

|

About The Special Meeting: Questions and Answers |

|

2 |

|

Proposal 1 – The Reverse Split Proposal |

|

7 |

|

Proposal 2 – The Authorized Share Increase Proposal |

|

14 |

|

Proposal 3 – The 2018 Employee Stock Incentive Plan Proposal |

|

17 |

|

Executive Compensation |

|

21 |

|

Director Compensation |

|

24 |

|

Proposal 4 – The Note Proposal |

|

25 |

|

Proposal 5 – The Warrant Proposal |

|

28 |

|

Proposal 6 – The Adjournment Proposal |

|

30 |

|

Security Ownership Of Certain Beneficial Owners and Management |

|

31 |

|

Other Matters |

|

32 |

|

|

|

|

|

Annex A – Form of Certificate of Amendment to the Articles of Incorporation to effect Reverse Split |

|

A-1 |

|

|

|

|

|

Annex B – Form of Certificate of Amendment to the Articles of Incorporation to effect the Authorized Share Increase |

|

B-1 |

|

|

|

|

|

Annex C – Form of 2018 Equity Incentive Plan |

|

C-1 |

|

|

|

|

|

Annex D – Form of Proxy Card |

|

D-1 |

IMPORTANT NOTICE

WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIAL MEETING, YOU ARE REQUESTED TO VOTE OVER THE INTERNET, BY TELEPHONE, OR MARK, DATE AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT AS PROMPTLY AS POSSIBLE IN THE ENCLOSED ENVELOPE. VOTING BY USING THE ABOVE METHODS WILL NOT PREVENT YOU FROM VOTING IN PERSON AT THE MEETING.

THANK YOU FOR ACTING PROMPTLY

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON February 2, 2018

The Notice of Special Meeting and Proxy Statement are also available at www.proxyvote.com.

1

About The Special Meeting: Questions And Answers

What am I voting on?

At the Special Meeting, you will be asked to:

(1) approve an amendment to our Restated Articles of Incorporation, as amended (the “Articles of Incorporation”), to effect a reverse stock split of our outstanding common stock, at a ratio between 1-for-5 and 1-for-60, to be determined at the discretion of the Board, for the purpose of complying with Nasdaq Listing Rule 5550(a)(2) (the “Reverse Split”), subject to the Board’s discretion to abandon the amendment (referred to in this Proxy Statement as, the “Reverse Split Proposal” or “Proposal 1”);

(2) approve an amendment to our Articles of Incorporation to increase the number of our authorized shares of common stock from 50,000,000 to 250,000,000 (the “Authorized Share Increase”) (referred to in this Proxy Statement as, the “Authorized Share Increase Proposal” or “Proposal 2”);

(3) approve our 2018 Employee Stock Incentive Plan, to be implemented at the discretion of the Board (referred to in this Proxy Statement as, the “2018 Employee Stock Incentive Plan Proposal” or “Proposal 3”);

(4) approve the issuance of shares of our common stock upon conversion of a convertible promissory note (the “Note”) issued to an accredited investor on November 17, 2017 in accordance with the terms of the Note, as required by and in accordance with Nasdaq Listing Rule 5635 (referred to in this Proxy Statement as, the “Note Proposal” or “Proposal 4”);

(5) approve the issuance of shares of our common stock upon exercise of the warrants to purchase common stock (the “Warrants”) to be issued to accredited investors pursuant to a securities purchase agreement, dated January 5, 2018, in accordance with the terms of the Warrants, as required by and in accordance with Nasdaq Listing rule 5635(d) (referred to in this Proxy Statement as, the “Warrant Proposal” or Proposal 5”);

(6) approve the adjournment of the Special Meeting, if necessary, to continue to solicit votes on the above proposals if sufficient votes to pass the proposals are not received in time for the Special Meeting (referred to in this Proxy Statement as, the “Adjournment Proposal” or “Proposal 6”); and

(7) transact any other business properly brought before the Special Meeting or any adjournments thereof.

Who is entitled to vote at the Special Meeting, and how many votes do they have?

Stockholders of record at the close of business on January 8, 2018 (the “Record Date”) may vote at the Special Meeting. Pursuant to the rights of our stockholders contained in our charter documents each share of our common stock has one vote. There were 47,078,788 shares of common stock outstanding on January 8, 2018. From January 8, 2018 through February 1, 2018, you may inspect a list of stockholders eligible to vote. If you would like to inspect the list, please call Wendy Loundermon, our Vice President of Finance and Secretary, at (703) 665-0585 to arrange a visit to our offices. In addition, the list of stockholders will be available for viewing by stockholders at the Special Meeting

How do I vote?

You may vote over the Internet, by telephone, by mail or in person at the Special Meeting. Please be aware that if you vote over the Internet, you may incur costs such as Internet access charges for which you will be responsible.

Vote by Internet. Registered stockholders can vote via the Internet at www.proxyvote.com. You will need to use the control number appearing on your proxy card to vote via the Internet. You can use the Internet to transmit your voting instructions up until 11:59 p.m. Eastern Time on February 1, 2018. Internet voting is available 24 hours a day. If you vote via the Internet, you do not need to return a proxy card.

Vote by Telephone. Registered stockholders can vote by telephone by calling the toll-free telephone number 1-800-690-6903. You will need to use the control number appearing on your proxy card to vote by telephone. You may transmit your voting instructions from any touch-tone telephone up until 11:59 p.m. Eastern Time on February 1, 2018. Telephone voting is available 24 hours a day. If you vote by telephone, you do not need to vote over the Internet or return a proxy card.

2

Vote by Mail. If you are a registered stockholder and received a printed proxy card, you can vote by marking, dating and signing it, and returning it in the postage-paid envelope provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717, as instructed in the proxy card. Please promptly mail your proxy card to ensure that it is received prior to the closing of the polls at the Special Meeting.

Vote in Person at the Meeting. If you attend the Special Meeting and plan to vote in person, we will provide you with a ballot at the Special Meeting. If your shares are registered directly in your name, you are considered the stockholder of record and you have the right to vote in person at the Special Meeting. If your shares are held in the name of your broker or other nominee, you are considered the beneficial owner of shares held in street name. As a beneficial owner, if you wish to vote at the Special Meeting, you will need to bring to the Special Meeting a legal proxy from your broker or other nominee authorizing you to vote those shares.

If your Shares are held in “Street Name.” If your shares are held in the name of a bank, broker or other nominee (a “Nominee”), you will receive separate voting instructions from your Nominee describing how to vote your shares. The availability of Internet voting will depend on the voting process of your Nominee. Please check with your Nominee and follow the voting instructions it provides.

You should instruct your Nominee how to vote your shares. If you do not give voting instructions to the Nominee, the Nominee will determine if it has the discretionary authority to vote on the particular matter. A Nominee cannot vote your shares on any matter that is not considered routine. Proposals 1 and 2 are considered routine matters, and your Nominee will be able to vote on these matters even if it does not receive instructions from you, so long as it holds your shares in its name. Proposals 3-7 are not considered routine matters. If you do not instruct your Nominee how to vote with respect to these matters, your Nominee may not vote with respect to these proposals and those votes will be counted as “broker non-votes.” Broker non-votes” are shares that are held in “street name” by a bank, brokerage firm or other nominee that indicates on its proxy that it does not have or did not exercise discretionary authority to vote on a particular matter. We encourage you to provide voting instructions to your Nominee. This ensures that your shares will be voted at the Special Meeting according to your instructions. You should receive directions from your Nominee about how to submit your voting instructions to them.

What is a proxy?

A proxy is a person you appoint to vote on your behalf. By using the methods discussed above, except voting in person at the meeting, you will be appointing Nadir Ali, our Chief Executive Officer, and Wendy Loundermon, our Vice President of Finance and Secretary, as your proxies. They may act together or individually to vote on your behalf, and will have the authority to appoint a substitute to act as proxy. If you are unable to attend the Special Meeting, please vote by proxy so that your shares of common stock may be voted.

How will my proxy vote my shares?

If you are a stockholder of record, your proxy will vote according to your instructions. If you choose to vote by mail and complete and return the enclosed proxy card but do not indicate your vote, your proxy will vote FOR any proposal for which you do not indicate your vote. We do not intend to bring any other matter for a vote at the Special Meeting, and we do not know of anyone else who intends to do so. Your proxies are authorized to vote on your behalf, however, using their best judgment, on any other business that properly comes before the Special Meeting.

How do I change my vote?

If you are a stockholder of record, you may revoke your proxy at any time before your shares are voted at the Special Meeting by:

• notifying our Secretary, Wendy Loundermon, in writing at 2479 E. Bayshore Road, Suite 195, Palo Alto, CA 94303, that you are revoking your proxy;

• submitting a proxy at a later date via the Internet, or by signing and delivering a proxy card relating to the same shares and bearing a later date than the date of the previous proxy prior to the vote at the Special Meeting, in which case your later-submitted proxy will be recorded and your earlier proxy revoked; or

• attending and voting by ballot at the Special Meeting.

3

If your shares are held in the name of a Nominee, you should check with your Nominee and follow the voting instructions your Nominee provides.

Who will count the votes?

A representative from Broadridge Financial Solutions, Inc., will act as the inspector of election and count the votes.

What constitutes a quorum?

A majority of our shares of common stock outstanding at the Record Date must be present in person or represented by proxy to hold the Special Meeting. This is called a quorum. For purposes of determining whether a quorum exists, we count as present any shares that are voted over the Internet, by telephone, by completing and submitting a proxy by mail or that are represented in person at the meeting. Further, for purposes of establishing a quorum, we will count as present shares that a stockholder holds even if the stockholder votes to abstain or only votes on one of the proposals. In addition, we will count as present shares held in “street name” by banks, brokerage firms or other nominees who indicate on their proxies that they do not have authority to vote those shares on Proposals 3, 4, 5 and 6. If a quorum is not present, we expect to adjourn the Special Meeting until we obtain a quorum.

What vote is required to approve each proposal?

Approval of the Reverse Split Proposal. For Proposal 1, the affirmative vote of the holders of shares of common stock representing a majority of the issued and outstanding shares of common stock entitled to vote at the Special Meeting will be required for approval. Proposal 1 is considered a routine matter. Therefore, if your shares are held by your Nominee in “street name” and you do not provide voting instructions with respect to your shares, your Nominee may vote your unvoted shares on Proposal 1. If you ABSTAIN from voting on Proposal 1, your shares will not be voted FOR or AGAINST the proposal. Because this Proposal 1 requires an affirmative vote of the outstanding shares entitled to vote at the Special Meeting, votes to ABSTAIN will effectively be counted as votes AGAINST the proposal.

Approval of the Authorized Share Increase Proposal. For Proposal 2, the affirmative vote of the holders of shares of common stock representing a majority of the issued and outstanding shares of common stock entitled to vote at the Special Meeting will be required for approval. Proposal 2 is considered a routine matter. Therefore, if your shares are held by your Nominee in “street name” and you do not provide voting instructions with respect to your shares, your Nominee may vote your unvoted shares on Proposal 2. If you ABSTAIN from voting on Proposal 2, your shares will not be voted FOR or AGAINST the proposal. Because this Proposal 2 requires an affirmative vote of the outstanding shares entitled to vote at the Special Meeting, votes to ABSTAIN will effectively be counted as votes AGAINST the proposal.

Approval of the 2018 Employee Stock Incentive Plan Proposal. For Proposal 3, the affirmative vote of the holders of shares of common stock representing a majority of the votes cast by the holders of all of the shares of common stock present or represented and entitled to vote at the Special Meeting will be required for approval of Proposal 3. Proposal 3 is not considered a routine matter. Therefore, if your shares are held by your Nominee in “street name” and you do not provide voting instructions with respect to your shares your Nominee cannot vote your shares on Proposal 3. Shares held in “street name” by banks, brokerage firms or other nominees who indicate on their proxies that they do not have authority to vote the shares on Proposal 3 will not be counted as votes FOR or AGAINST the proposal and will also not be counted as votes cast or shares voting on the proposal. If you ABSTAIN from voting on Proposal 3, your shares will not be voted FOR or AGAINST the proposal and will also not be counted as votes cast or shares voting on the proposal. As a result, such “broker non-votes” and votes to ABSTAIN will have no effect on the outcome of Proposal 3.

Approval of the Note Proposal. For Proposal 4, the affirmative vote of the holders of shares of common stock representing a majority of the votes cast by the holders of all of the shares of common stock present or represented and entitled to vote at the Special Meeting will be required for approval of Proposal 4. Proposal 4 is not considered a routine matter. Therefore, if your shares are held by your Nominee in “street name” and you do not provide voting instructions with respect to your shares your Nominee cannot vote your shares on Proposal 4. Shares held in “street name” by banks, brokerage firms or other nominees who indicate on their proxies that they do not have authority to vote the shares on Proposal 4 will not be counted as votes FOR or AGAINST the proposal and will also not be counted as votes cast or shares voting on the proposal. If you ABSTAIN from voting on Proposal 4, your shares will not be voted FOR or AGAINST the proposal and will also not be counted as votes cast or shares voting on the proposal. As a result, such “broker non-votes” and votes to ABSTAIN will have no effect on the outcome of Proposal 4.

4

Approval of the Warrant Proposal. For Proposal 5, the affirmative vote of the holders of shares of common stock representing a majority of the votes cast by the holders of all of the shares of common stock present or represented and entitled to vote at the Special Meeting will be required for approval of Proposal 5. Proposal 5 is not considered a routine matter. Therefore, if your shares are held by your Nominee in “street name” and you do not provide voting instructions with respect to your shares your Nominee cannot vote your shares on Proposal 5. Shares held in “street name” by banks, brokerage firms or other nominees who indicate on their proxies that they do not have authority to vote the shares on Proposal 5 will not be counted as votes FOR or AGAINST the proposal and will also not be counted as votes cast or shares voting on the proposal. If you ABSTAIN from voting on Proposal 5, your shares will not be voted FOR or AGAINST the proposal and will also not be counted as votes cast or shares voting on the proposal. As a result, such “broker non-votes” and votes to ABSTAIN will have no effect on the outcome of Proposal 5.

Approval of the Adjournment Proposal. For Proposal 6, the affirmative vote of the holders of shares of common stock representing a majority of the votes cast by the holders of all of the shares of common stock present or represented and entitled to vote at the Special Meeting will be required for approval of Proposal 6. Proposal 6 is not considered a routine matter. Therefore, if your shares are held by your Nominee in “street name” and you do not provide voting instructions with respect to your shares your Nominee cannot vote your shares on Proposal 6. Shares held in “street name” by banks, brokerage firms or other nominees who indicate on their proxies that they do not have authority to vote the shares on Proposal 6 will not be counted as votes FOR or AGAINST the proposal and will also not be counted as votes cast or shares voting on the proposal. If you ABSTAIN from voting on Proposal 6, your shares will not be voted FOR or AGAINST the proposal and will also not be counted as votes cast or shares voting on the proposal. As a result, such “broker non-votes” and votes to ABSTAIN will have no effect on the outcome of Proposal 6.

All Other Proposals. Any other proposal that might properly come before the meeting will require the affirmative vote of the holders of shares of common stock representing a majority of the votes cast by the holders of all of the shares of stock present or represented and entitled to vote on such matter at the meeting in order to be approved, except when a different vote is required by law, our Articles of Incorporation or our by-laws, as amended.

Abstentions and broker non-votes with respect to any matter will be counted as present and entitled to vote on that matter for purposes of establishing a quorum.

What percentage of our common stock do our directors and officers own?

As of January 8, 2018, our directors and executive officers beneficially owned less than 1% of our outstanding common stock, excluding shares of common stock issuable within sixty days. See the discussion under the heading “Security Ownership of Certain Beneficial Owners and Management” for more details.

Who is soliciting proxies, how are they being solicited, and who pays the cost?

We, on behalf of our Board, through our directors, officers, and employees, are soliciting proxies primarily by mail and the Internet. Further, proxies may also be solicited in person, by telephone, or facsimile. We will pay the cost of soliciting proxies. We will also reimburse stockbrokers and other custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to the owners of our common stock.

What are the recommendations of our Board?

The recommendations of our Board are set forth together with the description of each proposal in this Proxy Statement. In summary, the Board recommends a vote FOR all of the proposals. With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, in their own discretion.

If you sign and return your proxy card but do not specify how you want to vote your shares, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board.

Do any of the Company’s officers and directors have an interest in the proposals?

Yes. All of our executive officers and directors may participate in the proposed 2018 Employee Stock Incentive Plan and therefore, have an interest in Proposal 3.

5

Where can I find the voting results?

We will report the voting results in a Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”) within four business days following the end of the Special Meeting.

Who will pay the expenses incurred in connection with the solicitation of my vote?

We pay all costs and expenses related to preparation of these proxy materials and solicitation of your vote and all Special Meeting expenses. None of our directors, officers or employees will be specially compensated for these activities. We reimburse brokers, fiduciaries and custodians for their costs in forwarding proxy materials to beneficial owners of our common stock, but we will not pay any compensation for their services.

6

PROPOSAL 1 — THE REVERSE SPLIT PROPOSAL

Background of the Reverse Split Proposal

Our Board has unanimously adopted resolutions approving a proposal to amend our Articles of Incorporation to effect the Reverse Split of all our outstanding shares of common stock, at a ratio between 1-for-5 and 1-for-60, to be determined at the discretion of the Board, for the purpose of complying with Nasdaq Listing Rule 5550(a)(2), subject to the Board’s discretion to abandon such amendment. If this proposal is approved, the Board may decide not to effect the Reverse Split if it determines that it is not in the best interests of the Company to do so. The Board does not currently intend to seek re-approval of the Reverse Split for any delay in implementing the Reverse Split unless twelve months has passed from the date of the meeting (the “Authorized Period”). If the Board determines to implement the Reverse Split, it will become effective upon filing the amendment to the Articles of Incorporation with the Secretary of State of the State of Nevada or at such later date specified therein.

We previously asked our stockholders to approve the Reverse Split at our Annual Meeting held on December 8, 2017. Although at least a majority of the votes cast at the Annual Meeting voted in favor of the Reverse Split, under Nevada law the required vote is a majority of the outstanding shares our common stock. As a result, we are asking for approval of the Reverse Split at the Special Meeting in order to comply with Nasdaq Listing Rule 5550(a)(2).

The text of the form of the proposed amendment to our Articles of Incorporation to effect the Reverse Split, which assumes the approval of this Proposal 1, is attached hereto as Annex A.

Purpose of the Reverse Split

The primary purpose of the Reverse Split, if implemented, would be to potentially increase the market price of our common stock so that we can meet the minimum bid price rule requirements of Nasdaq. On August 14, 2017, we received a deficiency letter from Nasdaq indicating that, based on our closing bid price for the last 30 consecutive business days, we do not comply with the minimum bid price requirement of $1.00 per share, as set forth in Nasdaq Listing Rule 5550(a)(2). The notification has no immediate effect on the listing of our common stock on the Nasdaq Capital Market. In accordance with Nasdaq Listing Rule 5810(c)(3)(A), we have a grace period of 180 calendar days, or until February 12, 2018, to regain compliance with the minimum closing bid price requirement for continued listing. In order to regain compliance, the minimum closing bid price per share of our common stock must be at least $1.00 for a minimum of ten consecutive business days. In the event we do not regain compliance by February 12, 2018, we may be afforded an additional 180-day compliance period, provided we demonstrate that we meet all other applicable standards for listing on the Nasdaq Capital Market (except the bid price requirement), and provide written notice of our intention to cure the minimum bid price deficiency during the second grace period, by effecting a reverse stock split, if necessary. If we fail to regain compliance after the second grace period, our stock will be subject to delisting by Nasdaq.

As of January 8, 2018, the last reported closing price of our common stock was $0.2225. A delisting of our common stock may materially and adversely affect a holder’s ability to dispose of, or to obtain accurate quotations as to the market value, of, the common stock. In addition, any delisting may cause the common stock to be subject to “penny stock” regulations promulgated by the SEC. Under such regulations, broker-dealers are required to, among other things, comply with disclosure and special suitability determinations prior to the sale of shares of common stock. If our common stock becomes subject to these regulations, the market price of the common stock and the liquidity thereof could be materially and adversely affected. Reducing the number of outstanding shares of our common stock should, absent other factors, increase the per share market price of our common stock, although we cannot provide any assurance that our minimum bid price would remain above the minimum bid price requirement of Nasdaq, or that this theoretical increase would indeed occur. Accordingly, we believe that approval of authorization of the Board to effect the Reverse Split in its discretion is in the Company’s and our stockholders’ best interests.

In addition to increasing the market price of our common stock so that we can meet the minimum bid price rule requirements of Nasdaq, we believe that the Reverse Split could enhance the appeal of the common stock to the financial community, including institutional investors, and the general investing public. We believe that a number of institutional investors and investment funds are reluctant to invest in lower-priced securities and that brokerage firms may be reluctant to recommend lower-priced stock to their clients, which may be due in part to a perception that lower-priced securities are less promising as investments, are less liquid in the event that an investor wishes to sell its shares, or are less likely to be followed by institutional securities research firms and therefore to have less third-party

7

analysis of the Company available to investors. In addition, certain institutional investors or investment funds may be prohibited from buying stocks whose price is below a certain threshold. We believe that the reduction in the number of issued and outstanding shares of the common stock caused by the Reverse Split, together with the anticipated increased stock price immediately following and resulting from the Reverse Split, may encourage interest and trading in our common stock and thus possibly promote greater liquidity for our stockholders, thereby resulting in a broader market for the common stock than that which currently exists.

Reducing the number of outstanding shares of our common stock through the Reverse Split is intended, absent other factors, to increase the per share market price of our common stock. However, other factors, such as our financial results, market conditions and the market perception of our business, may adversely affect the market price of our common stock. As a result, there can be no assurance that the Reverse Split, if completed, will result in the intended benefits described above, that the market price of our common stock will increase following the Reverse Split or that the market price of our common stock will not decrease in the future. Additionally, we cannot assure you that the market price per share of our common stock after the Reverse Split will increase in proportion to the reduction in the number of shares of our common stock outstanding before such Reverse Split. Accordingly, the total market capitalization of our common stock after the Reverse Split may be lower than the total market capitalization before the Reverse Split.

We cannot be sure that our share price will comply with the requirements for continued listing of our shares of common stock on Nasdaq in the future or that we will comply with the other continued listing requirements. If our shares of common stock lose their status on Nasdaq, we believe that our shares of common stock would likely be eligible to be quoted on an inter-dealer electronic quotation and trading system operated by OTC Markets Group Inc.. These markets are generally considered to be less efficient than, and not as broad as, Nasdaq. Selling our shares of common stock on these markets could be more difficult because smaller quantities of shares would likely be bought and sold, and transactions could be delayed. In addition, in the event that our shares of common stock are delisted, broker-dealers have certain regulatory burdens imposed upon them, which may discourage them from effecting transactions in our common stock, further limiting the liquidity of our common stock. These factors could result in lower prices and larger spreads in the bid and ask prices for our common stock.

A delisting from Nasdaq and continued or further declines in our share price could also greatly impair our ability to raise additional necessary capital through equity or debt financing, and could significantly increase the ownership dilution to stockholders caused by the Company issuing equity in financing or other transactions. There are risks associated with the Reverse Split, including that the Reverse Split may not result in a sustained increase in the per share price of our common stock.

We cannot predict whether the Reverse Split will increase the market price for our common stock on a sustained basis, if at all. The history of similar stock split combinations for companies in like circumstances is varied. There is no assurance that:

• the market price per share of our common stock after the Reverse Split will rise in proportion to the reduction in the number of shares of our common stock outstanding before the Reverse Split, if it increases at all;

• the Reverse Split will result in a per share price that will attract brokers and investors who do not trade in lower priced stocks; and

• the market price per share will either exceed or remain in excess of the $1.00 minimum bid price as required by Nasdaq, or that we will otherwise meet the requirements of Nasdaq for continued inclusion for trading on the Nasdaq Capital Market.

The market price of our common stock will also be based on our performance and other factors, some of which are unrelated to the number of shares outstanding. If the Reverse Split is effected and the market price of our common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the Reverse Split. Furthermore, the liquidity of our common stock could be adversely affected by the reduced number of shares that would be outstanding after the Reverse Split.

8

Board Discretion to Implement the Reverse Split

If this proposal is approved by the Company’s stockholders, the Board will have the authority, in its sole determination without any further action necessary by the stockholders, to effect the Reverse Split during the Authorized Period at the ratio set forth above, as determined by the Board. The Board may, in its sole determination, choose to not effect the Reverse Split. The Board believes that granting this discretionary authority provides the Board with maximum flexibility to react to prevailing market conditions and future changes to the market price of our common stock, and therefore better enables it to act in the best interests of the Company. In addition to the Reverse Split, the Board is also pursuing other alternatives that may enable the Company to meet with the requirements for continued listing of our shares of common stock on Nasdaq. In exercising its discretion, the Board may consider the following factors:

• the historical trading price and trading volume of the Company’s common stock;

• the then-prevailing trading price and trading volume of the Company’s common stock and the anticipated impact of the Reverse Split on the trading market for the Company’s common stock; and

• the prevailing general market and economic conditions.

At the close of business on January 8, 2018, the Company had 47,078,788 shares of common stock issued and outstanding. Following the effectiveness of the Reverse Split, if implemented, at a 1-for-5 ratio, the Company would have approximately 9,815,758 shares of common stock issued and outstanding (without giving effect to the treatment of fractional shares or any issuances of common stock after January 8, 2018) following the Reverse Split and at a 1-for-60 ratio, the Company would have approximately 817,980 shares of common stock issued and outstanding (without giving effect to the treatment of fractional shares or any issuances of common stock after January 8, 2018) following the Reverse Split. The actual number of shares of common stock outstanding after giving effect to the Reverse Split will depend on the ratio that is ultimately selected by the Board, and the number of shares of common stock outstanding at the time the Reverse Split is effected. The Company does not expect the Reverse Split to have any economic effect on stockholders, warrant holders, debt holders or holders of options, except to the extent the Reverse Split results in fractional shares as discussed below.

Procedure for Effecting the Reverse Split

Subject to stockholder approval, if the Board decides to implement the Reverse Split, the Board will effect the split at a ratio between 1-for-5 and 1-for-60, to be determined at the discretion of the Board. We will file a Certificate of Amendment to our Articles of Incorporation, substantially in the form attached to this Proxy Statement as Annex A, with the Secretary of State of the State of Nevada to effect the Reverse Split. A Reverse Split would become effective at such time as the Certificate of Amendment is filed with the Secretary of State of the State of Nevada or at such later time as is specified therein. No further action on the part of the Company’s stockholders would be required and all shares of our common stock that were issued and outstanding immediately prior thereto would automatically be converted into new shares of our common stock based on the Reverse Split exchange ratio set by the Board based on the range set forth herein. As soon as practicable after the effective date of the Reverse Split, stockholders of record on the record date for the implemented Reverse Split would receive a letter from our transfer agent asking them to return the outstanding certificates representing our pre-split shares, which would be cancelled upon receipt by our transfer agent, and new certificates representing the post-split shares of our common stock would be sent to each of our stockholders. We will bear the costs of the issuance of the new stock certificates.

Effects of the Reverse Split

If the Reverse Split is approved by the stockholders and implemented by the Board, the principal effect will be to proportionately decrease the number of outstanding shares of common stock based on the split ratio. The shares of common stock are currently registered under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Company is thus subject to the periodic reporting and other requirements of the Exchange Act. A Reverse Split will not affect the registration of our common stock with the SEC or Nasdaq, where the common stock is currently listed. Following the Reverse Split, our common stock would continue to be listed on Nasdaq, assuming the Company’s compliance with the other continued listing standards of Nasdaq, although the common stock will receive a new CUSIP number.

9

Proportionate voting rights and other rights of the holders of shares of the Company’s common stock will not be affected by the Reverse Split, other than as a result of the treatment of fractional shares as described below. For example, a holder of 2% of the voting power of the outstanding shares immediately prior to the effectiveness of the Reverse Split will generally continue to hold 2% of the voting power of the outstanding common stock after the Reverse Split. The number of stockholders of record will not be affected by the Reverse Split, other than as a result of the treatment of fractional shares as described below. If approved and implemented, the Reverse Split may result in some stockholders owning “odd lots” of less than 100 shares. Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally somewhat higher than the costs of transactions in “round lots” of even multiples of 100 shares. The Board believes, however, that these potential effects are outweighed by the benefits to the Company of the Reverse Split.

The table, which does not take into account an increase in the authorized shares to 250,000,000, below illustrates the number of shares of common stock authorized for issuance following the Reverse Split, the approximate number of shares of common stock that would remain outstanding following the Reverse Split, and the number of unreserved shares of common stock available for future issuance following the Reverse Split. The information in the following table is based on 47,078,788 shares of common stock issued and outstanding as of January 8, 2018 and 1,778,852 shares reserved for future issuance as of January 8, 2018.

|

Proposed Ratio |

|

Number of |

|

Approximate |

|

Approximate |

|

1-for-5(1) |

|

50,000,000 |

|

9,415,758 |

|

40,228,471 |

|

1-for-60(1) |

|

50,000,000 |

|

784,647 |

|

49,185,705 |

(1) Any fractional shares that resulted from the Reverse Split have been rounded up to the nearest whole share.

As reflected in the table above, the number of authorized shares of our common stock will not be reduced by the Reverse Split. Accordingly, the Reverse Split will have the effect of creating additional unissued and unreserved shares of our common stock. We have no current arrangements or understandings providing for the issuance of any of the additional authorized and unreserved shares of our common stock that would be available as a result of the proposed Reverse Split. However, these additional shares may be used by us for various purposes in the future without further stockholder approval (subject to applicable Nasdaq Listing rules), including, among other things: (i) raising capital necessary to fund our future operations, (ii) providing equity incentives to our employees, officers, directors and consultants, (iii) entering into collaborations and other strategic relationships and (iv) expanding our business through the acquisition of other businesses or products.

Effect of the Reverse Stock Split on the 2011 Plan, 2018 Plan, Warrants, and Convertible or Exchangeable Securities

Based upon the split ratio, proportionate adjustments are generally required to be made to the per share exercise price and the number of shares issuable upon the exercise or conversion of all outstanding options, warrants, convertible or exchangeable securities entitling the holders to purchase, exchange for, or convert into, shares of common stock. This would result in approximately the same aggregate price being required to be paid under such options, warrants, convertible or exchangeable securities upon exercise, and approximately the same value of shares of common stock being delivered upon such exercise, exchange or conversion, immediately following the Reverse Split as was the case immediately preceding such split. The number of shares deliverable upon settlement or vesting of restricted stock awards will be similarly adjusted, subject to our treatment of fractional shares. The number of shares reserved for issuance pursuant to these securities will be proportionately based upon the ratio determined by the Board, subject to our treatment of fractional shares.

Accounting Matters

The amendment to the Articles of Incorporation will not affect the par value of our common stock per share, which will remain $0.001 par value per share. As a result, the stated capital attributable to common stock and the additional paid-in capital account on our balance sheet will not change due to the Reverse Split. Reported per share net income or loss will be higher because there will be fewer shares of common stock outstanding.

10

Effective Date

A Reverse Split would become effective upon the filing of a Certificate of Amendment to our Articles of Incorporation with the office of the Secretary of State of the State of Nevada or at such later date as is specified in such filing. On the effective date, shares of common stock issued and outstanding, in each case, immediately prior thereto, will be combined and converted, automatically and without any action on the part of the stockholders, into new shares of common stock in accordance with the ratio determined by the Board within the limits set forth in this proposal.

No Going Private Transaction

Notwithstanding the decrease in the number of outstanding shares following the implementation of the Reverse Split, the Board does not intend for this transaction to be the first step in a “going private transaction” within the meaning of Rule 13e-3 of the Exchange Act and the implementation of the proposed Reverse Split will not cause the Company to go private.

Treatment of Fractional Shares

No fractional shares would be issued if, as a result the Reverse Split, a registered stockholder would otherwise become entitled to a fractional share. Instead, stockholders who otherwise would be entitled to receive fractional shares because they hold a number of shares not evenly divisible by the ratio of the Reverse Split will automatically be entitled to receive an additional share of the Company’s common stock. In other words, any fractional share will be rounded up to the nearest whole number.

Book-Entry Shares

If the Reverse Split is effected, stockholders who hold uncertificated shares (i.e., shares held in book-entry form and not represented by a physical share certificate), either as direct or beneficial owners, will have their holdings electronically adjusted by the Company’s transfer agent (and, for beneficial owners, by their brokers or banks that hold in “street name” for their benefit, as the case may be) to give effect to the Reverse Split.

Stockholders who hold uncertificated shares as direct owners will be sent a statement of holding from the Company’s transfer agent that indicates the number of shares owned in book-entry form.

Certificated Shares

If the Reverse Split is effected, stockholders holding certificated shares (i.e., shares represented by one or more physical share certificates) will receive a transmittal letter from the Company’s transfer agent promptly after the effectiveness of the Reverse Split. The transmittal letter will be accompanied by instructions specifying how stockholders holding certificated shares can exchange certificates representing the pre-split shares for a statement of holding.

Beginning after the effectiveness of the Reverse Split, each certificate representing shares of our pre-split common stock will be deemed for all corporate purposes to evidence ownership of post-split common stock.

STOCKHOLDERS SHOULD NOT DESTROY ANY PRE-SPLIT STOCK CERTIFICATE AND SHOULD NOT SUBMIT ANY CERTIFICATES UNTIL THEY ARE REQUESTED TO DO SO.

Possible Effects of Additional Issuances of Common Stock and History of Prior Reverse Splits

Following the effective time of the Reverse Split, there will be an increase in the number of authorized but unissued shares of our common stock. Under the Nevada Revised Statutes (the “NRS”), the Board can issue additional shares of common stock without stockholder approval, which would have the effect of diluting existing holders of our common stock.

Additional shares of common stock, if issued, would have a dilutive effect upon the percentage of equity of the Company owned by our present stockholders. The issuance of such additional shares of common stock might be disadvantageous to current stockholders in that any additional issuances would potentially reduce per share dividends, if any. Stockholders should consider, however, that the possible impact upon dividends is likely to be minimal in view of the fact that the Company does not intend to pay any dividends on its common stock in the foreseeable future. In addition, the issuance of such additional shares of common stock, by reducing the percentage of equity of the Company owned by present stockholders, would reduce such present stockholders’ ability to influence the election of directors or any other action taken by the holders of common stock.

11

In the future the Board could, subject to its fiduciary duties and applicable law, use the increased number of authorized but unissued shares to frustrate persons seeking to take over or otherwise gain control of our Company by, for example, privately placing shares with purchasers who might side with the Board in opposing a hostile takeover bid. Shares of common stock could also be issued to a holder that would thereafter have sufficient voting power to assure that any proposal to amend or repeal the Company’s by-laws, as amended, or Articles of Incorporation would not receive the requisite vote. Such uses of the Company’s common stock could render more difficult, or discourage, an attempt to acquire control of the Company if such transactions were opposed by the Board. A result of the anti-takeover effect of the increase in the number of authorized shares could be that stockholders would be denied the opportunity to obtain any advantages of a hostile takeover, including, but not limited to, receiving a premium to the then current market price of our common stock, if the same was so offered by a party attempting a hostile takeover of our Company. The Company is not aware of any party’s interest in or efforts to engage in a hostile takeover attempt as of the date of this Proxy Statement.

On November 8, 2016, our stockholders approved a reverse stock split at a ratio between 1-for-5 and 1-for-15, in the discretion of our Board. On the same date, the Board determined to effect a reverse stock split of the Company’s common stock at a 1-for-15 ratio (the “2016 Reverse Stock Split”). The 2016 Reverse Stock Split became effective as of March 1, 2017.

The Company effected the 2016 Reverse Stock Split for some of the same reasons for which the Board is recommending the proposed reverse stock split. The trading price of the common stock was below the $1.00 minimum bid price required under Nasdaq Listing Rule 5550(a)(2) for 30 consecutive business days. On March 1, 2017, the first trading day after the effectiveness of the 2016 Reverse Stock Split, the closing price of the common stock on the Nasdaq Capital Market was $3.90 per share.

On December 6, 2013, our Board and stockholders holding a majority of our outstanding voting power approved a resolution authorizing our Board to effect a reverse split of our common stock at an exchange ratio of 1-for-2 (the “2014 Reverse Stock Split”). The 2014 Reverse Stock Split became effective as of April 9, 2014.

The Company effected the 2014 Reverse Stock Split for to meet the Nasdaq Capital Market listing requirements. On April 9, 2014, the first trading day after the effectiveness of the 2014 Reverse Stock Split, the closing price of the common stock on the Nasdaq Capital Market was $3.80 per share.

Certain Material U.S. Federal Income Tax Consequences of a Reverse Stock Split

The following discussion summarizes certain material U.S. federal income tax consequences relating to the participation in a reverse stock split by a U.S. stockholder that holds the shares as a capital asset. This discussion is based on the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), final, temporary and proposed U.S. Treasury regulations promulgated thereunder and current administrative rulings and judicial decisions, all as in effect as of the date hereof. All of these authorities may be subject to differing interpretations or repealed, revoked or modified, possibly with retroactive effect, which could materially alter the tax consequences set forth herein.

For purposes of this summary, a “U.S. stockholder” refers to a beneficial owner of common stock who is any of the following for U.S. federal income tax purposes: (i) a citizen or resident of the United States, (ii) a corporation created or organized in or under the laws of the United States, any state thereof, or the District of Columbia, (iii) an estate the income of which is subject to U.S. federal income taxation regardless of its source, or (iv) a trust if (1) its administration is subject to the primary supervision of a court within the United States and one or more U.S. persons have the authority to control all of its substantial decisions, or (2) it has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person. A non-U.S. holder of common stock is a stockholder who is not a U.S. stockholder.

This summary does not represent a detailed description of the U.S. federal income tax consequences to a stockholder in light of his, her or its particular circumstances. In addition, it does not purport to be complete and does not address all aspects of federal income taxation that may be relevant to stockholders in light of their particular circumstances or to any stockholder that may be subject to special tax rules, including, without limitation: (1) stockholders subject to the alternative minimum tax; (2) banks, insurance companies, or other financial institutions; (3) tax-exempt organizations; (4) dealers in securities or commodities; (5) regulated investment companies or real estate investment trusts; (6) traders in securities that elect to use a mark-to-market method of accounting for their securities holdings; (7) U.S. stockholders whose “functional currency” is not the U.S. dollar; (8) persons holding common stock as a position

12

in a hedging transaction, “straddle,” “conversion transaction” or other risk reduction transaction; (9) persons who acquire shares of common stock in connection with employment or other performance of services; (10) dealers and other stockholders that do not own their shares of common stock as capital assets; (11) U.S. expatriates; (12) foreign persons; (13) resident alien individuals; or (14) stockholders who directly or indirectly hold their stock in an entity that is treated as a partnership for U.S. federal tax purposes. Moreover, this description does not address the U.S. federal estate and gift tax, alternative minimum tax, or other tax consequences of the Reverse Split.

There can be no assurance that the Internal Revenue Service (the “IRS”) will not take a contrary position to the tax consequences described herein or that such position will be sustained by a court. In addition, U.S. tax laws are subject to change, possibly with retroactive effect, which may result in U.S. federal income tax considerations different from those summarized below. No opinion of counsel or ruling from the IRS has been obtained with respect to the U.S. federal income tax consequences of the Reverse Split.

This discussion is for general information only and is not tax advice. All stockholders should consult their own tax advisors with respect to the U.S. federal, state, local and non-U.S. tax consequences of the Reverse Split.

Based on the assumption that the Reverse Split will constitute a tax-free reorganization within the meaning of Section 368(a)(1)(E) of the Code, and subject to the limitations and qualifications set forth in this discussion, the following U.S. federal income tax consequences should result from the Reverse Split:

• A stockholder should not recognize gain or loss in the Reverse Split;

• the aggregate tax basis of the post-Reverse Split shares should be equal to the aggregate tax basis of the pre-Reverse Split shares; and

• the holding period of the post-Reverse Split shares should include the holding period of the pre-Reverse Split shares.

THE PRECEDING DISCUSSION IS INTENDED ONLY AS A SUMMARY OF CERTAIN FEDERAL INCOME TAX CONSEQUENCES OF A REVERSE SPLIT AND DOES NOT PURPORT TO BE A COMPLETE ANALYSIS OR DISCUSSION OF ALL POTENTIAL TAX EFFECTS RELEVANT THERETO. YOU SHOULD CONSULT YOUR OWN TAX ADVISORS AS TO THE PARTICULAR FEDERAL, STATE, LOCAL, FOREIGN AND OTHER TAX CONSEQUENCES OF A REVERSE SPLIT IN LIGHT OF YOUR SPECIFIC CIRCUMSTANCES.

No Appraisal Rights

Under the NRS, stockholders are not entitled to rights of appraisal with respect to the proposed amendment to our Articles of Incorporation to effect the Reverse Split, and we will not independently provide our stockholders with any such right.

Vote Required

The affirmative vote of the holders of shares of common stock representing a majority of the common stock issued and outstanding on the Record Date will be required for approval of the Reverse Split Proposal.

The Board recommends that you vote FOR the approval of the Reverse Split Proposal.

13

PROPOSAL 2 — THE AUTHORIZED SHARE INCREASE PROPOSAL

Background of the Authorized Share Increase Proposal

Our Board has determined that it is advisable and in our and our stockholders’ best interests to increase the number of authorized shares of common stock from 50,000,000 to 250,000,000 shares, par value $0.001 per share. Accordingly, stockholders are asked to approve an amendment to our Articles of Incorporation to effectuate such increase.

The Board strongly believes that the increase in the number of authorized shares of common stock is necessary to provide us with resources and flexibility with respect to our capital sufficient to execute our business plans and strategy.

The number of authorized shares of common stock following the amendment of our Articles of Incorporation as a result of the approval of this Proposal 2 will not be reduced by the reverse stock split.

Accordingly, the Board has unanimously approved a resolution proposing such amendment to our Articles of Incorporation and directed that it be submitted for approval at the Special Meeting.

We previously asked our stockholders to approve the Authorized Share Increase at our Annual Meeting held on December 8, 2017. Although at least a majority of the votes cast at the Annual Meeting voted in favor of the Authorized Share Increase, under Nevada law the required vote is a majority of the outstanding shares our common stock. As a result, we are asking for approval of the Authorized Share Increase at the Special Meeting.

The text of the form of the proposed amendment to our Articles of Incorporation to effect the Authorized Share Increase, which assumes the approval of this Proposal 2, is attached hereto as Annex B.

Of the 50,000,000 shares of common stock currently authorized, 47,078,788 shares of common stock were outstanding as of January 8, 2018, in addition to the following:

• 3,167,293 shares of common stock authorized for issuance under the 2011 Employee Stock Incentive Plan, as amended (the “2011 Plan”), of which 218,893 shares of common stock are underlying outstanding options having a weighted average exercise price of $25.64 per share and 2,949,300 are available for future issuance subject to us effecting an increase in or authorized shares of common stock;

• 1,204,844 shares of common stock issuable upon the exercise of outstanding warrants, having a weighted average exercise price of $1.43 per share;

• 4,200,925 shares of common stock which may be issued upon the conversion of the outstanding principal balance of $1,745,000 plus interest of the Note at a conversion price of $0.45 subject to a most favored nation provision for dilutive issuances with a floor of $0.29 per share (the “Floor Price”) for up to 6,518,679 shares of common stock. Subject to stockholder approval in accordance with Nasdaq Listing Rules 5635(b) and 5635(d), which is being sought in Proposal 4 below, the conversion price of the Note may be reduced to a price that is equal to 70% of the closing bid price of the Company’s common stock as reported by the Nasdaq Stock Market as of the date immediately prior to each applicable conversion date subject to a floor of $0.10. If the issuance of the additional shares of common stock at such lower price is approved by stockholders in Proposal 4, an aggregate of 18,904,160 shares of common stock will be issuable upon conversion of the Note;

• 10,090,285 shares of common stock upon the conversion of the outstanding principal balance of $1,004,719 plus accrued interest as of January 5, 2018 of $5,135 of those certain 8% Original Issue Discount Senior Secured Convertible Debentures (the “Debentures”), at a conversion price that is equal to a 30% discount to the closing price of the Company’s common stock as reported by the Nasdaq Stock Market as of the date immediately prior to each applicable conversion date subject to a floor of $0.10. The Debentures are not convertible until the Company files an amendment to its Articles of Incorporation to effect the Authorized Share Increase;

• 120,000 shares of common stock reserved for issuance to investor relations firms;

14

• 235,115 shares of common stock required to be reserved for issuance to a provider pursuant to a service provider agreement; and

• 17,994,359 shares of common stock underlying the Warrants subject to us effecting the Authorized Share Increase.

The number of shares outstanding or reserved for issuance under outstanding options, warrants and other derivative securities set forth above does not reflect the Reverse Split set forth in Proposal 1 above and the additional shares of common stock issuable under the 2018 Plan set forth in Proposal 3 below. If the Reverse Split is approved, such number of outstanding shares, but not the number of authorized shares, would be adjusted proportionally.

Reasons for the Proposed Increase in Number of Authorized Shares of Common Stock

To provide us with resources and flexibility with respect to our capital sufficient to execute our business plans and strategy. The increase in authorized shares of common stock will provide us greater flexibility with respect to our capital structure for various purposes as the need may arise from time to time. These purposes may include: raising capital, establishing strategic relationships with other companies, expanding our business through the acquisition of other businesses or products and providing equity incentives to employees, officers or directors. In addition, the Warrants described in Proposal 5 below are not exercisable until the date on which we file an amendment to our Articles of Incorporation to increase the number of authorized shares of the Company’s common stock such that all of the Warrants may be exercised in full by the holders of the Warrants, subject to stockholder approval which is being sought in this proposal, and (iii) receipt of stockholder approval as required by and in accordance with Nasdaq Listing Rule 5635(d). According to the terms of the Warrant, the Company is prohibited from issuing any additional shares of common stock or common stock equivalents until the initial exercise date of the Warrants. Accordingly, the approval of this Proposal 2 will permit holders to exercise their Warrants, assuming stockholders also approve Proposal 5 at the Special Meeting and six months have passed since issuance, which, if exercised for cash, will result in additional cash proceeds to the Company. Such additional funds will strengthen the Company’s capital position. If stockholders do not approve the amendment to increase the Company’s authorized shares, it will be prohibited for issuing any additional securities which will have a significant impact on the Company’s ability to raise capital and support its operations in connection with the sale of its equity securities. In addition, in connection with the November 2017 SPA, described in Proposal 4, and that certain 8% Original Issue Discount Senior Secured Convertible Debenture an event of default will be triggered if the Company is not able to increase its authorized shares of Common Stock as of February 15, 2018. If the Company is not able to raise capital through the sale of its equity securities and an event of default is triggered on the Company’s outstanding securities, it could result in a material adverse effect on the Company’s operations.

Principal Effects of Increase in Number of Authorized Shares of Common Stock

If stockholders approve this Proposal 2, the additional authorized common stock will have rights identical to the currently outstanding shares of our common stock. The proposed amendment will not affect the par value of the common stock, which will remain at $0.001 per share. Approval of this Proposal 2 and issuance of the additional authorized shares of common stock would not affect the rights of the holders of currently outstanding shares of our common stock, except for effects incidental to increasing the number of shares of our common stock outstanding, such as dilution of any earnings per share and voting rights of current holders of common stock.

The additional shares of common stock authorized by the approval of this Proposal 2 could be issued by our Board without further vote of our stockholders except as may be required in particular cases by our Articles of Incorporation, the NRS or other applicable law, regulatory agencies or Nasdaq rules. Stockholders do not have preemptive rights to subscribe to additional securities that we may issue, which means that current stockholders do not have a prior right thereunder to purchase any new issue of common stock, or securities that are convertible into common stock, in order to maintain their proportionate ownership interests in the Company.

Our stockholders are not entitled to dissenters’ or appraisal rights under the NRS with respect to the proposed amendment to our Articles of Incorporation to increase the number of authorized shares of common stock and we will not independently provide the stockholders with any such right if the increase is implemented.

The proposed amendment to our Articles of Incorporation to increase the number of authorized shares of our common stock could, under certain circumstances, have an anti-takeover effect. The additional shares of common stock that would become available for issuance if this Proposal 2 is approved could also be used by us to oppose a hostile

15

takeover attempt or to delay or prevent changes in control or our management. For example, without further stockholder approval, the Board could adopt a “poison pill” which would, under certain circumstances related to an acquisition of our securities not approved by the Board, give certain holders the right to acquire additional shares of common stock at a low price, or the Board could strategically sell shares of common stock in a private transaction to purchasers who would oppose a takeover or favor the current Board.

Although this proposal to increase the authorized capital and common stock has been prompted by business and financial considerations and not by the threat of any hostile takeover attempt (nor is the Board currently aware of any such attempts directed at us), nevertheless, stockholders should be aware that approval of this Proposal 2 could facilitate future efforts by us to deter or prevent changes in control, including transactions in which the stockholders might otherwise receive a premium for their shares over then current market prices.

Vote Required

The affirmative vote of the holders of shares of common stock representing a majority of the common stock issued and outstanding on the Record Date will be required for approval of the Authorized Share Increase Proposal.

The Board recommends that you vote FOR the approval of the Authorized Share Increase Proposal.

16

Proposal 3 — THE 2018 EMPLOYEE STOCK INCENTIVE PLAN PROPOSAL

Background of the 2018 Employee Stock Incentive Plan Proposal

We are asking our stockholders to approve the 2018 Employee Stock Incentive Plan (the “2018 Plan”), our new employee stock incentive plan. If approved by stockholders and subsequently implemented by our Board, the 2018 Plan will be utilized in conjunction with the 2011 Plan for employees, corporate officers, directors, consultants and other key persons employed or retained by us. Approval of the 2018 Plan shall not affect awards already granted under the 2011 Plan.

Similar to the 2011 Plan, the 2018 Plan is intended to promote financial saving for the future by our employees, fosters good employee relations, and encourages employees to acquire shares of our common stock, thereby better aligning their interests with those of the other stockholders. Therefore, the Board believes it is essential to our ability to attract, retain, and motivate highly qualified employees in an extremely competitive environment both in the United States and internationally.

Current Equity Plans

The table below provides information as of December 31, 2017 regarding the 2011 Plan and such other compensation plans under which equity securities of the Company have been authorized for issuance.

|

Plan Category |

|

Number of |

|

Weighted-average |

|

Number of |

||

|

Equity compensation plans approved by security holders |

|

218,893 |

|

|

$ |

22.92 |

|

2,949,300 |

|

Equity compensation plans not approved by security holders |

|

41,667 |

(1) |

|

$ |

40.50 |

|

0 |

|

Total |

|

260,560 |

|

|

$ |

25.74 |

|

2,949,300 |

____________

(1) Options granted to Nadir Ali on August 14, 2013.

Material Features of the 2018 Plan

The following is a summary of the material features of the 2018 Plan and its operation. The summary is qualified in its entirety by reference to the full text of the 2018 Plan, which is attached hereto as Annex C.

• If implemented by our Board and subsequent to the Authorized Share Increase and/or the Reverse Split, the number of shares of our common stock reserved for issuance under the 2018 Plan will be 2,000,000, which number will be automatically increased annually on the first day of each quarter, beginning on April 1, 2018 and for each quarter thereafter through October 1, 2028, by a number of shares of common stock equal to the least of (i) 1,000,000 Shares, (ii) twenty percent (20%) of the outstanding shares of common stock on the last day of the immediately preceding calendar quarter, or (iii) such number of shares that may be determined by the Board.

Types of Awards. The 2018 Plan will provide for the granting of incentive stock options, NQSOs, stock grants and other stock-based awards, including Restricted Stock and Restricted Stock Units (as defined in the 2018 Plan).

• Incentive and Nonqualified Stock Options. The plan administrator will determine the exercise price of each stock option. The exercise price of an NQSO may not be less than the fair market value of our common stock on the date of grant. The exercise price of an incentive stock option may not be less than the fair market value of our common stock on the date of grant if the recipient holds 10% or less of the combined voting power of our securities, or 110% of the fair market value of a share of our common stock on the date of grant otherwise.

17