PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on September 30, 2016

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Sysorex Global

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

☐ Fee paid previously with preliminary materials:

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1. | Amount previously paid: |

| 2. | Form, Schedule or Registration Statement No.: |

| 3. | Filing Party: |

| 4. | Date Filed: |

Sysorex Global

2479 E. Bayshore Road, Suite 195

Palo Alto, CA 94303

ANNUAL MEETING OF STOCKHOLDERS

To be Held November 8, 2016

Dear Stockholder:

You are hereby invited to attend the Annual Meeting of Stockholders of Sysorex Global (the “Company”) on November 8, 2016, which will be held at 2479 E. Bayshore Road, Suite 195, Palo Alto, CA 94303 at 12:00 p.m., local time (the “Annual Meeting”). Enclosed with this letter are your Notice of Annual Meeting of Stockholders, Proxy Statement and Proxy voting card. The Proxy Statement included with this notice discusses each of our proposals to be considered at the Annual Meeting. Please also review our annual report on Form 10-K and Form 10-K/A for the year ended December 31, 2015 which is included with these materials and is available on our website at http://www.sysorex.com (under “Investors”).

At this year’s annual meeting, you will be asked to: (1) elect five directors to serve until our next annual meeting or until the election and qualification of their successors; (2) authorize an amendment to our Restated Articles of Incorporation to effect a reverse stock split of our common stock at a ratio between 1-for-5 and 1-for-10, to be determined at the discretion of the Company’s Board of Directors (the “Board”), for the purpose of complying with NASDAQ Listing Rule 5550(a)(2), subject to the Board’s discretion to abandon such amendment (the “Reverse Split Proposal”); (3) approve, in accordance with NASDAQ Listing Rule 5635(d), the potential issuance in excess of 20% of our outstanding shares of common stock (the “Conversion Shares”) in connection with the conversion of securities issued to Hillair Capital Investment L.P. (“Hillair”) and any resulting change of control, as defined by NASDAQ Listing Rule 5635(b) (the “20% Issuance Proposal”); (4) ratify the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016; (5) approve the adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the meeting to approve the Reverse Split Proposal and/or the 20% Issuance Proposal; and (6) transact such other business as may properly come before the Annual Meeting or any adjournments thereof.

Our board of directors has fixed the close of business on October 5, 2016 as the record date for determining the stockholders entitled to notice of and to vote at the Annual Meeting and any adjournment and postponements thereof.

I hope that you attend the Annual Meeting in person. Whether or not you plan to be with us, please vote over the Internet or complete, sign, date, and return your voting card promptly in the enclosed envelope.

| Sincerely, | |

| /s/ Nadir Ali | |

| Nadir Ali | |

| Chief Executive Officer |

Palo

Alto, California

October 11, 2016

Sysorex Global

2479 E. Bayshore Road, Suite 195

Palo Alto, CA 94303

Notice of Annual Meeting of Stockholders

to be held November 8, 2016

To the Stockholders of Sysorex Global:

The 2016 Annual Meeting of Stockholders will be held at 2479 E. Bayshore Road, Suite 195, Palo Alto, CA 94303 at 12:00 p.m., local time, on November 8, 2016. During the Annual Meeting, stockholders will be asked to:

| (1) | elect five directors to serve until our next annual meeting or until the election and qualification of their successors; |

| (2) |

authorize an amendment to our Restated Articles of Incorporation to effect a reverse stock split of our common stock, at a ratio between 1-for-5 and 1-for-10, to be determined at the discretion of the Board, for the purpose of complying with NASDAQ Listing Rule 5550(a)(2), subject to the Board’s discretion to abandon the amendment (the “Reverse Split Proposal”); |

| (3) | approve, in accordance with NASDAQ Listing Rule and 5635(d), the potential issuance in excess of 20% of our outstanding shares of common stock (the “Conversion Shares”) in connection with the conversion of securities issued to Hillair Capital Investment L.P. (“Hillair”) and any resulting change of control, as defined in NASDAQ Listing Rule 5635(b) (the “20% Issuance Proposal”); |

| (4) | ratify the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016; | |

| (5) |

approve the adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the meeting to approve the Reverse Split Proposal and/or the 20% Issuance Proposal; and |

|

| (6) | transact any other business properly brought before the Annual Meeting or any adjournments thereof. |

If you are a stockholder as of October 5, 2016, you may vote at the meeting. The date of mailing this Notice of Meeting and Proxy Statement is on or about October 11, 2016.

By order of our board of directors,

| /s/ Kevin Harris | |

| Kevin Harris |

Chief Financial Officer

October 11, 2016

PROXY STATEMENT

This Proxy Statement and the accompanying proxy card are first being mailed, beginning on or about October 11, 2016, to owners of shares of common stock of Sysorex Global (which may be referred to in this Proxy Statement as “we,” “us,” “Sysorex,” or the “Company”) in connection with the solicitation of proxies by our Board of Directors (the “Board”) for our annual meeting of stockholders to be held on November 8, 2016 at 12:00 p.m., local time, at 2479 E. Bayshore Road, Suite 195, Palo Alto, CA 94303 (referred to as the “Annual Meeting”). This proxy procedure permits all stockholders, many of whom are unable to attend the Annual Meeting, to vote their shares at the Annual Meeting. Our Board encourages you to read this document thoroughly and to take this opportunity to vote on the matters to be decided at the Annual Meeting.

CONTENTS

IMPORTANT NOTICE

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, YOU ARE REQUESTED TO VOTE OVER THE INTERNET, BY TELEPHONE, OR MARK, DATE AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT AS PROMPTLY AS POSSIBLE IN THE ENCLOSED ENVELOPE. VOTING BY USING THE ABOVE METHODS WILL NOT PREVENT YOU FROM VOTING IN PERSON AT THE MEETING.

THANK YOU FOR ACTING PROMPTLY

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON NOVEMBER 8, 2016: The Notice of Annual Meeting, Proxy Statement and Annual Report on Form 10-K and Form 10-K/A for the year ended December 31, 2015 are also available at http://www.sysorex.com, which does not have “cookies” that identify visitors to the site.

About The Meeting: Questions And Answers

What am I voting on?

At this year’s meeting, you will be asked to:

| (1) | elect five directors to serve on the Board until the next annual meeting of stockholders or until the election and qualification of their successors; |

| (2) | authorize an amendment to our Restated Articles of Incorporation (the “Charter”) to effect a reverse stock split of our common stock, at a ratio between 1-for-5 and 1-for-10, to be determined at the discretion of the Board, for the purpose of complying with NASDAQ Listing Rule 5550(a)(2) (the “Reverse Split”), subject to the Board’s discretion to abandon the amendment (referred to in this proxy statement as, the “Reverse Split Proposal”); | |

| (3) | approve, in accordance with NASDAQ Listing Rule and 5635(d), the potential issuance in excess of 20% of our outstanding shares of common stock (the “Conversion Shares”) in connection with the conversion of securities issued to Hillair Capital Investment L.P. (“Hillair”) and any resulting change of control, as defined in NASDAQ Listing Rule 5635(b) (referred to in this proxy statement as the “20% Issuance Proposal”); |

| (4) | ratify the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016; |

| (5) |

approve the adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the meeting to approve the Reverse Split Proposal and/or the 20% Issuance Proposal; and |

|

| (6) | transact any other business properly brought before the Annual Meeting or any adjournments thereof. |

Who is entitled to vote at the Annual Meeting, and how many votes do they have?

Stockholders of record at the close of business on October 5, 2016 (the “Record Date”) may vote at the Annual Meeting. Pursuant to the rights of our stockholders contained in our charter documents each share of our common stock has one vote. There were 26,991,983 shares of common stock outstanding on October 5, 2016. From October 5, 2016 through November 7, 2016, you may inspect a list of stockholders eligible to vote. If you would like to inspect the list, please call Wendy Loundermon, our Vice President of Finance and Secretary, at (703) 665-0585 to arrange a visit to our offices. In addition, the list of stockholders will be available for viewing by stockholders at the Annual Meeting.

How do I vote?

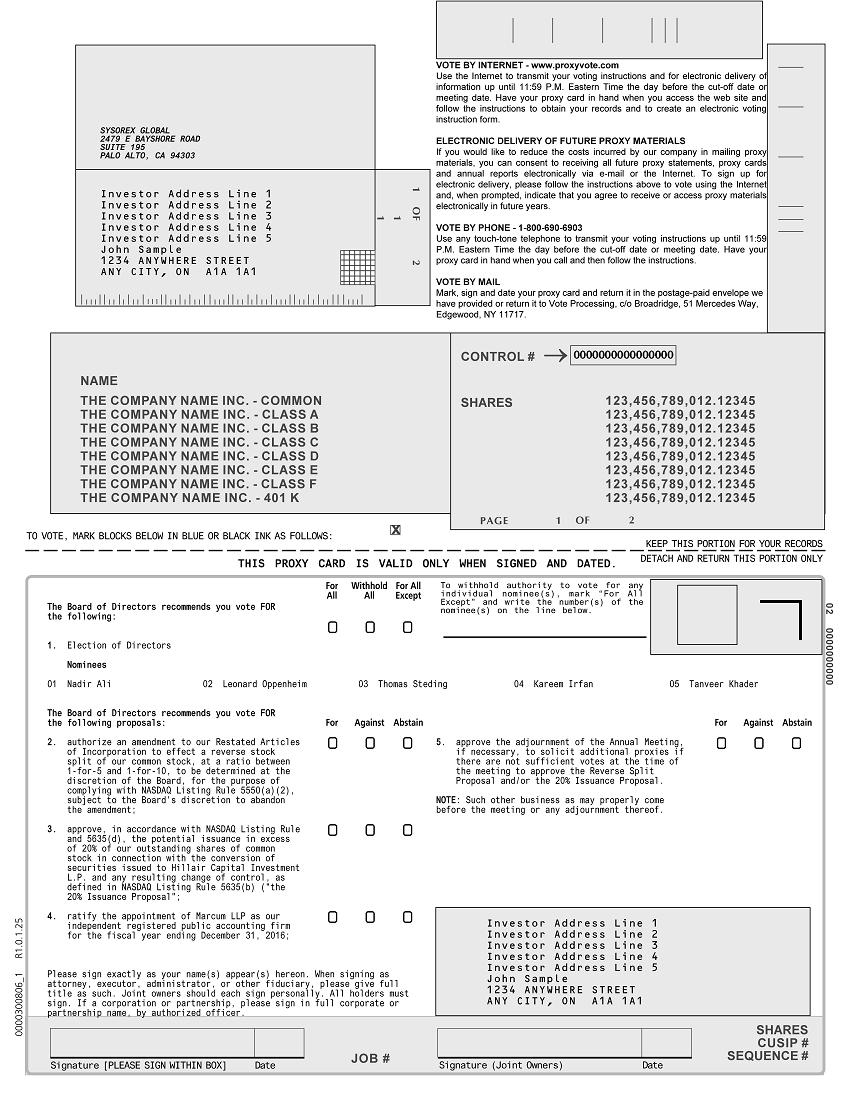

You may vote over the Internet, by mail or in person at the Annual Meeting. Please be aware that if you vote over the Internet, you may incur costs such as Internet access charges for which you will be responsible.

Vote by Internet. Registered stockholders can vote via the Internet at www.proxyvote.com. You will need to use the control number appearing on your proxy card to vote via the Internet. You can use the Internet to transmit your voting instructions up until 11:59 p.m. Eastern Time on November 7, 2016. Internet voting is available 24 hours a day. If you vote via the Internet, you do not need to return a proxy card.

Vote by Telephone. Registered stockholders can vote by telephone by calling the toll-free telephone number 1-800-690-6903. You will need to use the control number appearing on your proxy card to vote by telephone. You may transmit your voting instructions from any touch-tone telephone up until 11:59 p.m. Eastern Time on November 7, 2016. Telephone voting is available 24 hours a day. If you vote by telephone, you do not need to vote over the Internet or return a proxy card.

Vote by Mail. If you are a registered stockholder and received a printed proxy card, you can vote by marking, dating and signing it, and returning it in the postage-paid envelope provided to Sysorex Global. Please promptly mail your proxy card to ensure that it is received prior to the closing of the polls at the Annual Meeting.

Vote in Person at the Meeting. If you attend the Annual Meeting and plan to vote in person, we will provide you with a ballot at the Annual Meeting. If your shares are registered directly in your name, you are considered the stockholder of record and you have the right to vote in person at the Annual Meeting. If your shares are held in the name of your broker or other nominee, you are considered the beneficial owner of shares held in street name. As a beneficial owner, if you wish to vote at the Annual Meeting, you will need to bring to the Annual Meeting a legal proxy from your broker or other nominee authorizing you to vote those shares.

| 1 |

If your shares are held in the name of a bank, broker or other nominee (a “Nominee”), you will receive separate voting instructions from your Nominee describing how to vote your shares. The availability of Internet voting will depend on the voting process of your Nominee. Please check with your Nominee and follow the voting instructions it provides.

You should instruct your Nominee how to vote your shares. If you do not give voting instructions to the Nominee, the Nominee will determine if it has the discretionary authority to vote on the particular matter. Under applicable rules, brokers have the discretion to vote on routine matters, such as the ratification of the selection of accounting firms, but do not have discretion to vote on non-routine matters. Under the regulations applicable to New York Stock Exchange member brokerage firms (many of whom are the record holders of shares of our common stock), the uncontested election of directors is no longer considered a routine matter. Matters related to executive compensation are also not considered routine. As a result, if you are a beneficial owner and hold your shares in street name, but do not give your Nominee instructions on how to vote your shares with respect to these matters, votes may not be cast on your behalf. If your Nominee indicates on its proxy card that it does not have discretionary authority to vote on a particular proposal, your shares will be considered to be “broker non-votes” with regard to that matter. Broker non-votes and abstentions will be counted as present for purposes of determining whether enough votes are present to hold our Annual Meeting. A broker non-vote or abstention will not have any effect on a proposal where the requirement for approval is the affirmative vote of the majority of votes cast by the holders of all of the shares present in person or represented by proxy at the meeting and entitled to vote on such matter.

What is a proxy?

A proxy is a person you appoint to vote on your behalf. By using the methods discussed above except voting in person at the meeting, you will be appointing Nadir Ali, our Chief Executive Officer, and Kevin Harris, our Chief Financial Officer, as your proxies. They may act together or individually to vote on your behalf, and will have the authority to appoint a substitute to act as proxy. If you are unable to attend the Annual Meeting, please vote by proxy so that your shares of common stock may be voted.

How will my proxy vote my shares?

If you are a stockholder of record, your proxy will vote according to your instructions. If you choose to vote by mail and complete and return the enclosed proxy card but do not indicate your vote, your proxy will vote “FOR” the election of the nominated slate of directors (see Proposal 1); “FOR” the Reverse Split Proposal (see Proposal 2); “FOR” the 20% Issuance Proposal (see Proposal 3); “FOR” the ratification of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016 (see Proposal 4); and “FOR” the adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the meeting to approve the Reverse Split Proposal and/or the 20% Issuance Proposal (see Proposal 5). We do not intend to bring any other matter for a vote at the Annual Meeting, and we do not know of anyone else who intends to do so. Your proxies are authorized to vote on your behalf, however, using their best judgment, on any other business that properly comes before the Annual Meeting.

How do I change my vote?

If you are a stockholder of record, you may revoke your proxy at any time before your shares are voted at the Annual Meeting by:

| ● | notifying our Vice President of Financing and Secretary, Wendy Loundermon, in writing at 2479 E. Bayshore Road, Suite 195, Palo Alto, CA 94303, that you are revoking your proxy; |

| ● | submitting a proxy at a later date via the Internet, or by signing and delivering a proxy card relating to the same shares and bearing a later date than the date of the previous proxy prior to the vote at the Annual Meeting, in which case your later-submitted proxy will be recorded and your earlier proxy revoked; or |

| ● | attending and voting by ballot at the Annual Meeting. |

| 2 |

If your shares are held in the name of a Nominee, you should check with your Nominee and follow the voting instructions your Nominee provides.

Who will count the votes?

A representative from Broadridge Financial Solutions, Inc., will act as the inspector of election and count the votes.

What constitutes a quorum?

The holders of a majority of the eligible votes as of the record date, either present or represented by proxy, constitute a quorum. A quorum is necessary in order to conduct the Annual Meeting. If you choose to have your shares represented by proxy at the Annual Meeting, you will be considered part of the quorum. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum. If a quorum is not present at the Annual Meeting, the stockholders holding a majority of the eligible votes present in person or by proxy may adjourn the meeting to a later date. If an adjournment is for more than 45 days or a new record date is fixed for the adjourned meeting, we will provide notice of the adjourned meeting to each stockholder of record entitled to vote at the meeting.

Why is Sysorex seeking to implement the Reverse Split?

On November 30, 2015 the NASDAQ Capital Market (“NASDAQ”) notified the Company that it was not in compliance with NASDAQ Listing Rule 5550(a)(2), which requires the bid price of the Company’s common stock to be at least $1.00 per share. Subsequently, NASDAQ notified the Company that it would have until November 28, 2016 to regain compliance with the minimum bid price requirement. While the Company continues to seek alternative options, the Reverse Split is being proposed in order to increase the market price of our common stock to satisfy the $1.00 minimum closing bid price required to avoid the delisting of our common stock from The NASDAQ Global Select Market (“NASDAQ”), if necessary. In addition, a higher stock price may, among other things, increase the attractiveness of our common stock to the investment community.

What are the consequences of being delisted from NASDAQ?

If we are not able to satisfy the minimum closing bid price requirement prior to November 28, 2016 and we do not effect the Reverse Split in order to meet the $1.00 minimum closing bid price continued listing requirement of NASDAQ, our common stock would be delisted from NASDAQ. If we are delisted from NASDAQ, we may be forced to seek to be traded on the OTC Bulletin Board or the “pink sheets,” which would require our market makers to request that our common stock be so listed. There are a number of negative consequences that could result from our delisting from NASDAQ, including, but not limited to, the following:

| ● | the liquidity and market price of our common stock may be negatively impacted and the spread between the “bid” and “asked” prices quoted by market makers may be increased; | |

| ● | our access to capital may be reduced, causing us to have less flexibility in responding to our capital requirements; | |

| ● | our institutional investors may be less interested in or prohibited from investing in our common stock, which may cause the market price of our common stock to decline; | |

| ● | we will no longer be deemed a “covered security” under Section 18 of the Securities Act of 1933, as amended, and, as a result, we will lose our exemption from state securities regulations, making the granting of stock options and other equity incentives to our employees more difficult; and | |

| ● | if our stock is traded as a “penny stock,” transactions in our stock would be more difficult and cumbersome. |

What would be the principal effects of the Reverse Split?

If implemented, the Reverse Split will have the following effects:

| ● | the market price of our common stock immediately upon effect of the Reverse Split will increase substantially over the market price of our common stock immediately prior to the Reverse Split; and | |

| ● | the number of outstanding shares of common stock will be reduced to 5,398,397 if the Reverse Split is implemented at a ratio of 1 for 5 and 2,699,198 if the Reverse Split is implemented at a ratio of 1 for 10 (prior to taking into account the effect of eliminating fractional shares or any issuances of common stock after October 5, 2016). |

| 3 |

Are my pre-split stock certificates still good after the Reverse Split? Do I need to exchange them for new stock certificates?

If the Reverse Split is implemented, as of the effective date and time of the Reverse Split, each certificate representing pre-split shares of common stock will, until surrendered and exchanged, be deemed to represent only the relevant number of post-split shares of common stock. As soon as practicable after the effective date of the Reverse Split, our transfer agent, Corporate Stock Transfer, will mail you a letter of transmittal. Upon receipt of your properly completed and executed letter of transmittal and your stock certificate(s), you will be issued the appropriate number of shares of common stock either as stock certificates (including legends, if appropriate) or electronically in book-entry form, as determined by Sysorex.

What if I hold some or all of my shares electronically in book-entry form? Do I need to take any action to receive post-split shares?

If you hold shares of our common stock in book-entry form (that is, you do not have stock certificates evidencing your ownership of our common stock but instead received a statement reflecting the number of shares registered in your account), you do not need to take any action to receive your post-split shares, if the Reverse Split is implemented. If you are entitled to post-split shares, a transaction statement will be sent automatically to your address of record indicating the number of shares you hold.

What happens to any fractional shares resulting from the Reverse Split?

If you would be entitled to receive fractional shares as a result of the Reverse Split because you hold a number of shares of common stock before the reverse stock split that is not evenly divisible (in other words, it would result in a fractional interest following the Reverse Split), the Company shall not issue to any holder a fractional share of common stock on account of the Reverse Split. Rather, any fractional share of common stock resulting from such change shall be rounded upward to the nearest whole share of common stock. Share interests issued due to rounding are given solely to save the expense and inconvenience of issuing fractional shares of common stock and do not represent separately bargained for consideration.

What happens to equity awards under Sysorex’s Amended and Restated 2011 Employee Stock Incentive Plan as a result of the Reverse Split?

If the Reverse Split is implemented, all shares of common stock subject to the outstanding equity awards (including stock options, performance shares and restricted stock) under Sysorex’s Amended and Restated 2011 Employee Stock Incentive Plan (the “Plan”) will be converted upon the effective date and time of the Reverse Split into between 10-20% of such number of such shares immediately preceding the Reverse Split (subject to adjustment for fractional interests), depending on the Reverse Split Ratio approved by the Board. In addition, the exercise price of outstanding equity awards (including stock options and stock appreciation rights) will be adjusted to 5-10 times the exercise price specified before the Reverse Split. As a result, the approximate aggregate exercise price will remain the same following the Reverse Split. No fractional shares will be issued pursuant to the Plan following the Reverse Split. Therefore, if the number of shares subject to the outstanding equity awards immediately before the Reverse Split is not evenly divisible (in other words, it would result in a fractional interest following the Reverse Split), the number of shares of common stock issuable pursuant to such equity awards (including upon exercise of stock options and stock appreciation rights) will be rounded up to the nearest whole number.

What vote is required to approve each proposal?

Election of Directors. For Proposal 1, the election of directors, the nominees will be elected by a majority of the votes cast by the holders of shares of common stock present in person or represented by proxy and entitled to vote in the election. You may choose to vote, or withhold your vote, separately for each nominee. A properly executed proxy or voting instructions marked “Abstain” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for the purposes of determining whether there is a quorum.

| 4 |

Approval of the Reverse Split Proposal. For Proposal 2, the affirmative vote of the holders of shares of common stock representing a majority of the votes cast by the holders of all of the shares of common stock present in person or represented by proxy and entitled to voting on such matter will be required for approval.

Approval of the 20% Issuance Proposal. For Proposal 3, the affirmative vote of the holders of shares of common stock representing a majority of the votes cast by the holders of all of the shares of common stock present in person or represented by proxy and entitled to voting on such matter, other than Hillair, will be required for approval.

Ratification of the Appointment of Independent Registered Public Accounting Firm. For Proposal 4, the affirmative vote of the holders of shares of common stock representing a majority of the votes cast by the holders of all of the shares of common stock present in person or represented by proxy and entitled to voting on such matter will be required for approval.

Approval of Adjournment of the Annual Meeting, If Necessary, to Solicit Sufficient Votes to Approve the Reverse Split Proposal and/or the 20% Issuance Proposal. For Proposal 5, the affirmative vote of the holders of shares of common stock representing a majority of the votes cast by the holders of all of the shares of stock present in person or represented by proxy and entitled to voting on such matter will be required for approval.

Other Proposals. Any other proposal that might properly come before the meeting will require the affirmative vote of the holders of shares of common stock representing a majority of the votes cast by the holders of all of the shares of stock present or represented and entitled to voting on such matter at the meeting in order to be approved, except when a different vote is required by law, our Charter or our Bylaws.

Abstentions and broker non-votes with respect to any matter will be counted as present and entitled to vote on that matter for purposes of establishing a quorum. A broker non-vote or abstention will not have any effect on a proposal where the requirement for approval is the affirmative vote of the majority of votes cast by the holders of all of the shares present in person or represented by proxy at the meeting and entitled to vote on such matter. Accordingly, neither broker non-votes or abstentions will have any effect on Proposals 1 -5.

What percentage of our common stock do our directors and officers own?

As of October 5, 2016, our director-nominees and executive officers beneficially owned approximately 24% of our outstanding common stock, excluding shares of common stock issuable within sixty days. See the discussion under the heading “Security Ownership of Certain Beneficial Owners and Management” on page 19 for more details.

Who is soliciting proxies, how are they being solicited, and who pays the cost?

We, on behalf of our Board, through our directors, officers, and employees, are soliciting proxies primarily by mail and the Internet. Further, proxies may also be solicited in person, by telephone, or facsimile. We will pay the cost of soliciting proxies. We will also reimburse stockbrokers and other custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to the owners of our common stock.

Who is our Independent Registered Public Accounting Firm, and will they be represented at the Annual Meeting?

Marcum LLP served as the independent registered public accounting firm auditing and reporting on our financial statements for the fiscal year ended December 31, 2015 and has been appointed to serve as our independent registered public accounting firm for 2016. We expect that representatives of Marcum LLP will be physically present or be available via phone at the Annual Meeting. They will have an opportunity to make a statement, if they desire, and will be available to answer appropriate questions at the Annual Meeting.

| 5 |

What are the recommendations of our Board?

The recommendations of our Board are set forth together with the description of each proposal in this Proxy Statement. In summary, the Board recommends a vote:

| ● | FOR the election of the nominated directors (see Proposal 1); |

| ● | FOR the approval of the Reverse Split Proposal (see Proposal 2); |

| ● | FOR the approval of the 20% Issuance Proposal (see Proposal 3); | |

| ● | FOR the ratification of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016 (see Proposal 4); and | |

| ● |

FOR the approval to adjourn the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the meeting to approve the Reverse Split Proposal and/or the 20% Issuance Proposal (see Proposal 5). |

With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, in their own discretion.

If you sign and return your proxy card but do not specify how you want to vote your shares, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board.

| 6 |

EXECUTIVE OFFICERS, DIRECTORS, AND CORPORATE GOVERNANCE

The following table sets forth the names and ages of all of our directors and executive officers. Our officers are appointed by, and serve at the pleasure of, the Board. The Company’s Board consists of seven directors. Five of our seven current directors have been nominated for reelection and have consented to stand for reelection. Neither Geoffrey Lilien nor Abdus Salam Quieishi will stand for reelection, resulting in two vacancies. Mr. Lilien’s term will expire at the Annual Meeting, while Mr. Quieishi resigned from his positions with the Company, effective as of the close of business on September 30, 2016. The Board has not nominated individuals to fill the resulting vacancies. The terms of the rest of our current directors will expire at the Annual Meeting. after their election.

| Name | Age | Position | ||||

| Nadir Ali | 47 | Chief Executive Officer and Director | ||||

| Kevin Harris | 47 | Chief Financial Officer | ||||

| Bret Osborn | 51 | Chief Sales Officer | ||||

| Craig Harper | 50 | Chief Technology Officer | ||||

| Wendy Loundermon | 45 | Vice President of Finance and Secretary of Sysorex, President, CFO and Secretary of Sysorex Government Services, Inc., Vice President of Finance and Secretary of Sysorex USA and Secretary of Sysorex Canada Corp. | ||||

| Geoffrey Lilien | 52 | Director | ||||

| Leonard Oppenheim | 69 | Director | ||||

| Thomas Steding | 72 | Director | ||||

| Kareem Irfan | 56 | Director | ||||

| Tanveer Khader | 47 | Director | ||||

Nadir Ali

Mr. Ali was elected CEO and a Director of the Company in September 2011. Prior thereto, from 2001, he served as President of Sysorex Consulting Inc. and its subsidiaries. As CEO of the Company, Mr. Ali is responsible for establishing the vision, strategic intent, and the operational aspects of Sysorex. Mr. Ali works with the Sysorex executive team to deliver both operational and strategic leadership and has over 15 years of experience in the consulting and high tech industries. Prior to joining Sysorex, from 1998-2001, Nadir was the co-founder and Managing Director of Tira Capital, an early stage technology fund. Immediately prior thereto, Nadir served as Vice President of Strategic Planning for Isadra, Inc., an e-commerce software start-up. Nadir led the company’s capital raising efforts and its eventual sale to VerticalNet. From 1995 through 1998, Nadir was Vice President of Strategic Programs at Sysorex Information Systems (acquired by Vanstar Government Systems in 1997), a leading computer systems integrator. Nadir played a key operations role and was responsible for implementing and managing the company’s $1 billion plus in multi-year contracts. He worked closely with the investment bankers on the sale of Sysorex Information Systems to Vanstar in 1997. This started Mr. Ali’s mergers and acquisitions experience which was enhanced with additional M&A activity totaling $150 million. This experience is critical and relevant to Sysorex’s strategy today. Mr. Ali’s extensive experience in Sysorex’s core government business, as well as extensive contacts and relationships in Silicon Valley and Washington, D.C. were further considered by the Company in appointing Mr. Ali to the Board of Directors. From 1989 to 1994 he was a management consultant, first with Deloitte & Touche LLC in San Francisco and then independently. Mr. Ali received a Bachelor of Arts degree in Economics from the University of California at Berkeley in 1989. Mr. Ali’s valuable entrepreneurial, management, M&A and technology experience together with his in-depth knowledge of the Company provide him with the qualifications and skills to serve as a director of our Company. Mr. Ali is the son-in-law of Abdus Salam Qureishi, the Company’s Chairman of the Board.

Kevin Harris

Mr. Harris has been appointed to serve as the Company’s Chief Financial Officer, effective as of October 19, 2015. Prior to his appointment as Chief Financial Officer of the Company, Mr. Harris had served as the Vice President and Chief Financial Officer of Response Genetics, Inc. (NASDAQ: RGDX), a company focused on the development and sale of molecular diagnostic tests that help determine a patient’s response to cancer therapy, since June 12, 2013 and as the Interim Chief Financial Officer from August 2012 to June 12, 2013. Mr. Harris served as Chief Financial Officer and a director of CyberDefender Corporation (NASDAQ: CYDE listed from June 2010 to March 2014) from 2009 until August 2012 (and as interim Chief Executive Officer from August 2011 until August 2012). He also served as Chief Operating Officer of Statmon Technologies Corp. from 2004 to 2009. He began his career at KPMG Peat Marwick as a senior auditor. Mr. Harris’s other professional experience includes serving as Head of Production Finance at PolyGram Television, Director of Corporate Financial Planning at Metro-Goldwyn-Mayer Studios and Senior Vice President of Finance at RKO Pictures. Mr. Harris earned a Bachelor of Science in Business Administration from California State University, San Bernardino and is a Certified Public Accountant in the State of California.

| 7 |

Bret Osborn

Mr. Osborn joined Sysorex as President of Lilien Systems (“Lilien”, n/k/a. Sysorex USA) during the Company’s acquisition of Lilien on March 20, 2013. On May 21, 2015 he was appointed as Chief Sales Officer of the Company. Mr. Osborn is a seasoned, highly successful sales executive with responsibility for Sysorex’s global sales teams. He oversees the Company’s direct sales teams as well as its worldwide reseller partner and systems integration channels. Prior to joining Lilien in 2005, Mr. Osborn held various sales management positions with Blue Arc, EMC Corporation, and Lanier Worldwide.

Craig Harper

Mr. Harper joined Sysorex as Chief Technology Officer on June 24, 2014. Mr. Harper is a pioneer in Big Data, IaaS, SaaS, PaaS and Cloud based technologies. A visionary with nearly 30 years’ experience he leads Sysorex engineering and professional services teams in their development efforts. Mr. Harper’s prior experience includes 15 years of executive management experience within the cloud infrastructure and mobile application industries including serving as President of Apishpere, a wireless, location-based services company providing secure, scalable orchestration between devices and clouds. Mr. Harper earned an MBA from Babson College and BS degrees in Quantitative Economics & Decision Science, and Computer Science, from the University of California, San Diego.

Wendy Loundermon

Ms. Loundermon has overseen all of Sysorex’s finance, accounting and HR activities from 2002 until October 2014 and was re-appointed as Interim CFO of the Company effective January 2015 through October 2015. She has continued on with the Company as Vice President of Finance and President of Sysorex Government Services, Inc. Ms. Loundermon has over 20 years of finance and accounting experience. She is currently responsible for the preparation and filing of financial statements and reports for all companies, tax return filings, and managing the accounting staff. Ms. Loundermon received a Bachelor of Science degree in Accounting and a Master of Science degree in Taxation from George Mason University.

Geoffrey Lilien

Mr. Lilien was CEO of Lilien until March 31, 2015 and became a member of the Board upon the Company’s acquisition of Lilien on March 20, 2013. Prior thereto, he held the position of Chairman and CEO with Lilien since 1984, when he founded the Company. He has overseen Lilien’s growth from his being the only employee to having five offices in four states with over 50 employees. Mr. Lilien’s leadership in the reseller community includes his participation on HP Enterprise Council and Avnet Executive Partner Council, and he is regularly quoted in CRN and other trade press. In 2009, he received the VAR 500 Best Partnership Award recognizing nearly two decades of successful partnering with Hewlett-Packard. Mr. Lilien has a B.S. in Applied Science and Business from the University of San Francisco. Much of Lilien Systems’ longevity and success can be attributed to that company’s culture, which evolved under Mr. Lilien’s leadership. Mr. Lilien started out as a technologist and instituted the practice of having the most capable and communicative technical staff in the industry. Mr. Lilien’s valuable entrepreneurial, management, sales and technology experience together with his in-depth knowledge of Lilien’s business operations provide him with the qualifications and skills to serve as a director of our Company.

Leonard A. Oppenheim

Mr. Oppenheim has served as a director of the Company since July 29, 2011. Mr. Oppenheim retired from business in 2001 and has since been active as a private investor. From 1999 to 2001, he was a partner in Faxon Research, a company offering independent research to professional investors. From 1983 to 1999, Mr. Oppenheim was a principal in the Investment Banking and Institutional Sales division of Montgomery Securities. Prior to that, he was a practicing attorney. Mr. Oppenheim is a graduate of New York University Law School. Mr. Oppenheim served on the Board of Apricus Biosciences, Inc. (NASDAQ: APRI), a publicly held bioscience company, from June 2005 to May 2014. Mr. Oppenheim’s public company board experience is essential to the Company. Mr. Oppenheim also meets the Audit Committee Member requirements as a financial expert. Mr. Oppenheim’s public company board experience and financial knowledge provide him with the qualifications and skills to serve as a director of our Company.

| 8 |

Thomas L. Steding

Mr. Steding has served as a director of the Company since July 8, 2014. From April 2011 until March 2013, Mr. Steding was the Chief Executive Officer of Zephyr Photonics, a company which offers high performance optoelectronic solutions for harsh environments. From November 2008 until July 2010, he was the Chief Executive Officer of Red Condor, Inc., a managed service provider of email security systems for businesses, government agencies, and education and service providers. Prior to that, Mr. Steding was the Chief Executive Officer of numerous companies, including Liquid Engines, Inc., a tax software company, Stion Corp., a solar photovoltaic company, and Astoria Software, Inc., a complex document management company. Since 2007, Mr. Steding has served as Chairman of the Board for Linguastat, Inc., a company which provides a variety of services related to businesses’ product descriptions and other rich content for the web, mobile and tablet channels. He holds a Ph.D. in Electrical Engineering from University of California, Berkeley, California, and a MS in Management (Sloan Fellow) from Stanford University Graduate School of Business, Stanford, California. He also holds degrees in Electrical Engineering from the University of Michigan. Mr. Steding’s substantial executive management experience and his experience in business development with information technology companies give him the qualifications and skills to serve as a director of our Company.

Kareem M. Irfan

Mr. Irfan has served as a director of the Company since July 8, 2014. Since 2014, Mr. Irfan has been the CEO (Global Businesses) of Cranes Software International (Cranes), a business group offering business intelligence, data analytics and engineering software solutions and services. Previously, Mr. Irfan was Chief Strategy Officer at Cranes starting in 2011. From 2005 until 2011, he was General Counsel at Schneider Electric, a Paris-based global company which specializes in electricity distribution, automation and energy management solutions. Mr. Irfan served earlier as Chief IP & IT Counsel at Square D Co., a US-based electrical distribution and automation business and also practiced law at two international IP law firms in Chicago. Mr. Irfan is a graduate of DePaul University College of Law, holds a MS in Computer Engineering from the University of Illinois, and a BS in Electronics Engineering from Bangalore University. Mr. Irfan’s extensive experience in advising information technology companies, managing corporate governance and regulatory management policies, and over fifteen years of executive management leadership give him strong qualifications and skills to serve as a director of our Company.

Board of Directors

Our Board may establish the authorized number of directors from time to time by resolution. The current authorized number of directors is seven. Our current directors, if elected, will continue to serve as directors until the next annual meeting of stockholders and until his or her successor has been elected and qualified, or until his or her earlier death, resignation, or removal.

Our Board held 3 meetings during 2015. The Board also acted 16 times by unanimous written consent. All members of the board except Kareem Irfan attended more than 75% of the aggregate of the total number of meetings of the Board (held during the period for which he was a director). Members of our Board are invited and encouraged to attend each annual meeting of stockholders.

We continue to review our corporate governance policies and practices by comparing our policies and practices with those suggested by various groups or authorities active in evaluating or setting best practices for corporate governance of public companies. Based on this review, we have adopted, and will continue to adopt, changes that the Board believes are the appropriate corporate governance policies and practices for our Company.

| 9 |

Independence of Directors

In determining the independence of our directors, we apply the definition of “independent director” provided under the listing rules of The NASDAQ Stock Market LLC (“NASDAQ”). Pursuant to these rules, the Board has determined that all of the directors currently serving on the Board, are independent within the meaning of NASDAQ Listing Rule 5605 with the exception of Nadir Ali who is an executive officer, and Geoffrey Lilien who was employed by a subsidiary of the Company through December 31, 2015.

Committees of our Board

The Board has three standing committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee.

Audit Committee

The Audit Committee consists of three directors. Leonard Oppenheim, Thomas Steding, and Kareem Irfan were the members through October 31, 2015, all of whom are “independent” as defined under section 5605(a)(2) of the NASDAQ Listing Rules. Effective November 1, 2015 Tanveer Khader, who is also independent, replaced Thomas Steding as a member of the committee. In addition, the Board has determined that Leonard Oppenheim qualifies as an “audit committee financial expert” as defined in the rules of the SEC. The Audit Committee operates pursuant to a charter, which can be viewed on our website at http://www.sysorex.com (under “Investors”). The Audit Committee met 6 times during 2015 with all members in attendance at each meeting, except Kareem Irfan and Leonard Oppenheim who were each not present at one of the meetings. All members attended more than 75% of such committee meetings. The role of the Audit Committee is to:

| ● | oversee management’s preparation of our financial statements and management’s conduct of the accounting and financial reporting processes; |

| ● | oversee management’s maintenance of internal controls and procedures for financial reporting; |

| ● | oversee our compliance with applicable legal and regulatory requirements, including without limitation, those requirements relating to financial controls and reporting; |

| ● | oversee the independent auditor’s qualifications and independence; |

| ● | oversee the performance of the independent auditors, including the annual independent audit of our financial statements; |

| ● | prepare the report required by the rules of the Securities and Exchange Commission (the “SEC”) to be included in our Proxy Statement; and |

| ● | discharge such duties and responsibilities as may be required of the Committee by the provisions of applicable law, rule or regulation. |

Compensation Committee

The Compensation Committee consists of two directors, Leonard Oppenheim and Thomas Steding, all of whom are “independent” as defined in section 5605(a)(2) of the NASDAQ Listing Rules. The Compensation Committee did not hold an official meeting during 2015 but rather conducted business through written consents. The role of the Compensation Committee is to:

| ● | develop and recommend to the independent directors of the Board the annual compensation (base salary, bonus, stock options and other benefits) for our President/Chief Executive Officer; |

| 10 |

| ● | review, approve and recommend to the independent directors of the Board the annual compensation (base salary, bonus and other benefits) for all of our Executive Officers (as used in Section 16 of the Securities Exchange Act of 1934 and defined in Rule 16a-1 thereunder); |

| ● | review, approve and recommend to the Board the aggregate number of equity grants to be granted to all other employees; and |

| ● | ensure that a significant portion of executive compensation is reasonably related to the long-term interest of our stockholders. |

A copy of the charter of the Compensation Committee is available on our website at http://www.sysorex.com (under “Investors”).

The Compensation Committee may form and delegate a subcommittee consisting of one or more members to perform the functions of the Compensation Committee. The Compensation Committee may engage outside advisers, including outside auditors, attorneys and consultants, as it deems necessary to discharge its responsibilities. The Compensation Committee has sole authority to retain and terminate any compensation expert or consultant to be used to provide advice on compensation levels or assist in the evaluation of director, President/Chief Executive Officer or senior executive compensation, including sole authority to approve the fees of any expert or consultant and other retention terms. In addition, the Compensation Committee considers, but is not bound by, the recommendations of our Chief Executive Officer with respect to the compensation packages of our other executive officers.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee, or the “Governance Committee”, consists of three directors, Leonard Oppenheim, Thomas Steding and Tanveer Khader, all of whom are “independent” as defined in section 5605(a)(2) of the NASDAQ Listing Rules. The Governance Committee acted one time during 2015 with all members in attendance. The role of the Governance Committee is to:

| ● | evaluate from time to time the appropriate size (number of members) of the Board and recommend any increase or decrease; |

| ● | determine the desired skills and attributes of members of the Board, taking into account the needs of the business and listing standards; |

| ● | establish criteria for prospective members, conduct candidate searches, interview prospective candidates, and oversee programs to introduce the candidate to us, our management, and operations; |

| ● | annually recommend to the Board persons to be nominated for election as directors; |

| ● | recommend to the Board the members of all standing Committees; |

| ● | periodically review the “independence” of each director; |

| ● | adopt or develop for Board consideration corporate governance principles and policies; and |

| ● | provide oversight to the strategic planning process conducted annually by our management. |

A copy of the charter of the Governance Committee is available on our website at http://www.sysorex.com (under “Investors”).

| 11 |

Stockholder Communications

Stockholders may communicate with the members of the Board, either individually or collectively, by writing to the Board at 2479 E. Bayshore Road, Suite 195, Palo Alto, CA 94303. These communications will be reviewed by the Secretary as agent for the non-employee directors in facilitating direct communication to the Board. The Secretary will treat communications containing complaints relating to accounting, internal accounting controls, or auditing matters as reports under our Whistleblower Policy. Further, the Secretary will disregard communications that are bulk mail, solicitations to purchase products or services not directly related either to us or the non-employee directors’ roles as members of the Board, sent other than by stockholders in their capacities as such or from particular authors or regarding particular subjects that the non-employee directors may specify from time to time, and all other communications which do not meet the applicable requirements or criteria described below, consistent with the instructions of the non-employee directors.

General Communications. The Secretary will summarize all stockholder communications directly relating to our business operations, the Board, our officers, our activities or other matters and opportunities closely related to us. This summary and copies of the actual stockholder communications will then be circulated to the Chairman of the Governance Committee.

Stockholder Proposals and Director Nominations and Recommendations. Stockholder proposals are reviewed by the Secretary for compliance with the requirements for such proposals set forth in our Bylaws and in Regulation 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (“Exchange Act”). Stockholder proposals that meet these requirements will be summarized by the Secretary. Summaries and copies of the stockholder proposals are circulated to the Chairman of the Governance Committee.

Stockholder nominations for directors are reviewed by the Secretary for compliance with the requirements for director nominations that are set forth in our Bylaws. Stockholder nominations for directors that meet these requirements are summarized by the Secretary. Summaries and copies of the nominations or recommendations are then circulated to the Chairman of the Governance Committee.

The Governance Committee will consider director candidates recommended by stockholders. If a director candidate is recommended by a stockholder, the Governance Committee expects to evaluate such candidate in the same manner it evaluates director candidates it identifies. Stockholders desiring to make a recommendation to the Governance Committee should follow the procedures set forth above regarding stockholder nominations for directors.

Retention of Stockholder Communications. Any stockholder communications which are not circulated to the Chairman of the Governance Committee because they do not meet the applicable requirements or criteria described above will be retained by the Secretary for at least ninety calendar days from the date on which they are received, so that these communications may be reviewed by the directors generally if such information relates to the Board as a whole, or by any individual to whom the communication was addressed, should any director elect to do so.

Distribution of Stockholder Communications. Except as otherwise required by law or upon the request of a non-employee director, the Chairman of the Governance Committee will determine when and whether a stockholder communication should be circulated among one or more members of the Board and/or Company management.

Director Qualifications and Diversity

The Board seeks independent directors who represent a diversity of backgrounds and experiences that will enhance the quality of the Board’s deliberations and decisions. Candidates should have substantial experience with one or more publicly traded companies or should have achieved a high level of distinction in their chosen fields. The Board is particularly interested in maintaining a mix that includes individuals who are active or retired executive officers and senior executives, particularly those with experience in technology; research and development; finance, accounting and banking; or marketing and sales.

There is no difference in the manner in which the Governance Committee evaluates nominees for director based on whether the nominee is recommended by a stockholder. In evaluating nominations to the Board, the Governance Committee also looks for depth and breadth of experience within the Company’s industry and otherwise, outside time commitments, special areas of expertise, accounting and finance knowledge, business judgment, leadership ability, experience in developing and assessing business strategies, corporate governance expertise, and for incumbent members of the Board, the past performance of the incumbent director. Each of the candidates nominated for election to our Board was recommended by the Governance Committee.

| 12 |

Code of Business Conduct and Ethics

The Board has adopted a code of business conduct and ethics (the “Code”) designed, in part, to deter wrongdoing and to promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with or submits to the Securities and Exchange Commission and in the Company’s other public communications, compliance with applicable governmental laws, rules and regulations, the prompt internal reporting of Code violations to an appropriate person or persons, as identified in the Code and accountability for adherence to the Code. The Code applies to all directors, executive officers and employees of the Company. The Code is periodically reviewed by the Board. In the event we determine to amend or waive certain provisions of the Code, we intend to disclose such amendments or waivers on our website at http://www.sysorex.com under the heading “Investors” within four business days following such amendment or waiver or as otherwise required by the NASDAQ Listing Rules.

Risk Oversight

Our Board provides risk oversight for our entire company by receiving management presentations, including risk assessments, and discussing these assessments with management. The Board’s overall risk oversight, which focuses primarily on risks and exposures associated with current matters that may present material risk to our operations, plans, prospects or reputation, is supplemented by the various committees. The Audit Committee discusses with management and our independent registered public accounting firm our risk management guidelines and policies, our major financial risk exposures and the steps taken to monitor and control such exposures. Our Compensation Committee oversees risks related to our compensation programs and discusses with management its annual assessment of our employee compensation policies and programs. Our Governance Committee oversees risks related to corporate governance and management and director succession planning.

Board Leadership Structure

The Chairman of the Board presides at all meetings of the Board. Currently, the offices of Chairman of the Board and Chief Executive Officer are separated. The Company has no fixed policy with respect to the separation of the offices of the Chairman of the Board and Chief Executive Officer. The Board believes that the separation of the offices of the Chairman of the Board and Chief Executive Officer is in the best interests of the Company and will review this determination from time to time.

Director Compensation

The following table provides certain summary information concerning compensation awarded to, earned by or paid to our Directors in the year ended December 31, 2015 expect those Directors who were also Named Executive Officers and whose compensation information has been disclosed above.

| Name | Fees Earned or paid in cash ($) |

Stock awards ($) |

Option awards ($) |

Non-equity Incentive plan compensation ($) |

Nonqualified deferred compensation earnings ($) |

All other compensation ($) |

Total ($) |

|||||||||||||||||||||

| Leonard Oppenheim | $ | 45,500 | $ | 44,872 | $ | 16,960 | - | - | - | $ | 107,332 | |||||||||||||||||

| Thomas Steding | $ | 43,500 | $ | 32,200 | $ | 35,360 | - | - | $ | 23,750 | (1) | $ | 134,810 | |||||||||||||||

| Kareem Irfan | $ | 31,250 | $ | 32,200 | $ | 16,960 | - | - | - | $ | 80,410 | |||||||||||||||||

| Tanveer Khader | $ | 31,000 | $ | 32,200 | $ | 16,960 | - | - | - | $ | 80,160 | |||||||||||||||||

| A. Salam Qureishi | $ | - | $ | - | $ | - | - | - | $ | 360,000 | (1) | $ | 360,000 | |||||||||||||||

| Geoffrey Lilien | $ | - | $ | - | $ | - | - | - | $ | 197,905 | (2) | $ | 197,905 | |||||||||||||||

| (1) | Compensation under a consulting agreement as fully described in Item 13. |

| (2) | Compensation as an employee of Lilien Systems to include salary, bonus and auto allowance. |

| 13 |

Directors are entitled to reimbursement of ordinary and reasonable expenses incurred in exercising their responsibilities and duties as a director. Additionally, on July 14, 2014 the Board approved to award its independent directors the following compensation for fiscal year 2014 (July 2014 – June 2015) (subject to a definitive agreement): $20,000 per year for their services rendered on the Board, $2,500 per year for service on a committee, a non-qualified stock option grant to purchase 10,000 shares of the Company’s common stock under the Company’s 2011 Employee Stock Incentive Plan which was amended and restated on May 2, 2014 (the “Plan”), and a restricted stock award of 20,000 shares of common stock under the Plan, which will vest in increments of 5,000 shares per quarter over a period of one year from the grant date. Effective July 1, 2015 the Board approved the following compensation plan for the independent directors: $30,000 per year for their services rendered on the Board, $15,000 per year for service as the audit committee chair, $10,000 per year for service as the compensation committee chair, $6,000 per year for service on the audit committee, $4,000 per year for service on the compensation committee, $2,500 per year for service on the Governance Committee, a non-qualified stock option grant to purchase 20,000 shares of the Company’s common stock under the Company’s Employee Stock Incentive Plan, and a restricted stock award of 20,000 shares of common stock under the Plan, which will vest in increments of 5,000 shares per quarter over a period of one year from the grant date. The payment of any portion of the above compensation, including the grants of any securities under the Plan shall be subject to the terms and conditions of definitive agreements to be entered into between the Company and its independent directors.

Compliance with Section 16 of the Exchange Act

Based solely upon a review of Forms 3 and 4 and amendments thereto furnished to us under Rule 16a-3(e) during the year ended December 31, 2015, Forms 5 and any amendments thereto furnished to us with respect to the year ended December 31, 2015, and the representations made by the reporting persons to us, we believe that the following person(s) who, at any time during such fiscal year was a director, officer or beneficial owner of more than 10% of the Company’s common stock, failed to comply with all Section 16(a) filing requirements during the fiscal year:

| Name | Number of Late Reports |

Number of Transactions not Reported on a Timely Basis |

Failure to File a Required Form |

|||||||||

| Nadir Ali | 1* | 1 | 0 | |||||||||

| Wendy Loundermon | 1** | 1 | 0 | |||||||||

| * | Mr. Ali was late filing a Form 4 reflecting an acquisition of stock options on April 17, 2015. |

| ** | Ms. Loundermon was late filing a Form 4 reflecting an acquisition of stock options on May 9, 2015. |

| 14 |

EXECUTIVE COMPENSATION AND RELATED INFORMATION

The table below sets forth, for the last two fiscal years, the compensation earned by (i) each individual who served as our principal executive officer, (ii) our two other most highly compensated executive officers, other than our principal executive officer, who were serving as an executive officer at the end of the last fiscal year, and (iii) up to two additional individuals for whom disclosure would have been provided pursuant to the preceding paragraph (ii) but for the fact that the individual was not serving as an executive officer of the Company at the end of the last completed fiscal year. Together, these three individuals are sometimes referred to as the “Named Executive Officers.”

| Name and Principal Position | Year | Salary ($) |

Bonus ($) |

Option Awards ($) |

All Other Compensation ($) |

Total ($) |

||||||||||||||||||

| Nadir Ali, | 2015 | $ | 252,400 | $ | 266,329 | $ | 507,500 | (1) | $ | 183,399 | (2) | $ | 1,209,629 | |||||||||||

| Chief Executive Officer of Sysorex | 2014 | $ | 240,000 | $ | 140,000 | $ | - | $ | 153,711 | (2) | $ | 533,711 | ||||||||||||

| Bret Osborn, | 2015 | $ | 180,000 | $ | 374,840 | $ | 188,600 | (1) | $ | 11,959 | (4) | $ | 755,399 | |||||||||||

| President of Lilien Systems | 2014 | $ | 180,000 | $ | 385,726 | $ | - | $ | 7,020 | (5) | $ | 572,746 | ||||||||||||

| Craig Harper, | 2015 | $ | 220,001 | $ | 110,000 | $ | 180,050 | (1) | $ | 7,020 | (5) | $ | 517,071 | |||||||||||

| Chief Technology Officer of Sysorex | 2014 | $ | 103,846 | $ | - | $ | 127,800 | (1) | $ | 3,510 | (5) | $ | 235,156 | |||||||||||

| (1) | The fair value of employee option grants are estimated on the date of grant using the Black-Scholes option pricing model with key weighted average assumptions, expected stock volatility and risk free interest rates based on US Treasury rates from the applicable periods. |

| (2) | Accrued vacation paid as compensation and housing allowance. |

| (3) | Accrued vacation paid as compensation. |

| (4) | Represents fringe benefits and auto allowance. |

| (5) | Represents an automobile allowance. |

Outstanding Equity Awards at Fiscal Year-End

Other than as set forth below, there were no outstanding unexercised options, unvested stock, and/or equity incentive plan awards issued to our named executive officers as of December 31, 2015.

| Option Awards | Stock Awards | |||||||||||||||||||||||||||||||||

| Name | Number of securities underlying unexercised options (#) exercisable | Number of securities underlying unexercised options (#) unexercisable | Equity incentive plan awards: number of securities underlying unexercised unearned options (#) |

Option exercise price ($) |

Option expiration date | Number of shares or units of stock that have not vested # |

Market value of shares of units of stock that have not vested ($) |

Equity incentive plan awards: number of unearned shares, units or other rights that have not vested (#) |

Equity incentive plan awards: market or payout value of unearned shares, units or other rights that have not vested ($)(1) |

|||||||||||||||||||||||||

| Nadir Ali | 125,000 | (1) | -0- | -0- | 0.312 | 12/21/2022 | -0- | -0- | -0- | -0- | ||||||||||||||||||||||||

| 156,250 | (2) | 468,750 | (2) | -0- | 2.70 | 08/12/2023 | -0- | -0- | -0- | -0- | ||||||||||||||||||||||||

| 93,750 | (3) | 406,250 | (3) | -0- | 2.32 | 04/17/2025 | -0- | -0- | -0- | -0- | ||||||||||||||||||||||||

| Bret Osborn | 16,666 | (3) | 183,334 | (3) | -0- | 1.75 | 08/05/2025 | -0- | -0- | -0- | -0- | |||||||||||||||||||||||

| Craig Harper | 28,125 | (3) | 46,875 | (3) | -0- | 3.79 | 07/03/2024 | -0- | -0- | -0- | -0- | |||||||||||||||||||||||

| 28,645 | (3) | 96,355 | (3) | -0- | 1.56 | 02/12/2025 | -0- | -0- | -0- | -0- | ||||||||||||||||||||||||

| 8,333 | (3) | 91,667 | (3) | -0- | 1.75 | 08/05/2025 | -0- | -0- | -0- | -0- | ||||||||||||||||||||||||

| (1) | This option is 100% vested. |

| (2) | This option vests 25% on August 14, 2015 and vests 25% over the following three anniversaries of the grant date. |

| (3) | This option vests 1/48th per month at the end of each month starting on the grant date. |

| 15 |

Employment Agreements and Arrangements

On July 1, 2010, Nadir Ali entered into an “at will” Employment and Non-Compete Agreement, as subsequently amended, with the Sysorex Group, consisting of Sysorex Federal, Inc., Sysorex Government Services and Sysorex Consulting prior to their acquisition by the Company. Under the terms of the Employment Agreement Mr. Ali serves as President. The Employment Agreement was assumed by the Company and Mr. Ali became CEO in September 2011. Mr. Ali’s salary under the Agreement is $240,000 per annum plus other benefits including a bonus plan, a housing allowance, health insurance, life insurance and other standard Sysorex employee benefits. If Mr. Ali’s employment is terminated without Cause (as defined therein), he will receive his base salary for 12 months from the date of termination. Mr. Ali’s employment agreement provides that he will not compete with the Company for a period ending 12 months from termination and will be subject to non-solicitation provisions relating to employees, consultants and customers, distributors, partners, joint ventures or suppliers of the Company. On April 17, 2015, the Compensation Committee approved the increase of Mr. Ali’s annual salary to $252,400 per annum, effective January 1, 2015.

On March 20, 2013, upon the Company’s acquisition of Lilien Systems, Lilien Systems (“Lilien”, n/k/a. “Sysorex USA”) entered into a two year employment agreement with Bret Osborn to serve as President of Lilien Systems. Under the agreement Mr. Osborn’s salary was $180,000 per year and he was eligible to receive compensation under a bonus plan. If the contract was terminated by Lilien for Cause (as defined therein), or if Mr. Osborn resigned without Good Reason (as defined therein), Mr. Osborn shall only receive his compensation earned through the termination date. If the contract was terminated by Lilien without Cause or if Mr. Osborn terminated his employment for Good Reason, or upon a Change in Control (as defined therein), Mr. Osborn was also entitled to one year’s severance pay; all non-vested equity in the Company shall accelerate and vest on the date of termination and all healthcare and life insurance coverage through the end of the term shall be paid by the Company. After the expiration of the employment agreement Mr. Osborn’s compensation arrangement includes an annual salary of $180,000 plus other benefits including a bonus plan, commission plan and auto allowance.

Craig Harper joined the Company on June 24, 2014. His compensation arrangements include an annual salary of $200,000 plus other benefits including a bonus plan, commission plan and auto allowance. Effective July 1, 2015 Mr. Harper’s annual salary was increased to $240,000 per year.

Securities Authorized for Issuance under Equity Compensation Plans

On September 1, 2011 our Board and stockholders adopted the 2011 Employee Stock Incentive Plan, which was amended and restated on May 2, 2014 (the Amended and Restated 2011 Employee Stock Incentive Plan is referred to as the “Plan”). The purpose of the Plan is to provide an incentive to attract and retain directors, officers, consultants, advisors and employees whose services are considered valuable, to encourage a sense of proprietorship, and to stimulate an active interest of these persons in our development and financial success. Under the Plan, as amended, we are authorized to issue up to 2,634,500 shares of Common Stock, with yearly increases equal to 10% of the number of shares issued during the prior calendar year, including incentive stock options intended to qualify under Section 422 of the Internal Revenue Code of 1986, as amended, non-qualified stock options, stock appreciation rights, performance shares, restricted stock and long term incentive awards. On June 18, 2015 the stockholders approved an amendment to the Plan increasing the number of shares of common stock authorized for awards under the Plan by 3,000,000, subject to annual increases. Thus, effective as of January 1, 2016, an aggregate of 6,756,033 shares are authorized for grant under the Plan. The Plan is administered by our Board until authority is delegated to a committee of the Board.

The table below provides information as of December 31, 2015 regarding the Plan and such other compensation plans under which equity securities of the Company have been authorized for issuance.

| Plan Category | Number of securities to be issued upon exercise of outstanding options (a) |

Weighted- average exercise price of outstanding (b) |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column a) (c) |

|||||||||

| Equity compensation plans approved by security holders | 4,128,049 | $ | 1.89 | 2,627,984 | ||||||||

| Equity compensation plans not approved by security holders | 625,000 | (1) | $ | 2.70 | 0 | |||||||

| Total | 4,753,049 | $ | 2.00 | 2,627,984 | ||||||||

| (1) | Options granted to Nadir Ali on August 14, 2013. |

| 16 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of September 27, 2016, regarding the beneficial ownership of our common stock by the following persons:

| ● | each person or entity who, to our knowledge, owns more than 5% of our common stock; | |

| ● | our executive officers as defined in Item 402(a)(3) of Regulation S-K; | |

| ● | each director; and | |

| ● | all of our executive officers and directors as a group. |

Unless otherwise indicated in the footnotes to the following table, each person named in the table has sole voting and investment power and that person’s address is c/o Sysorex Global, 2479 E. Bayshore Road, Suite 195, Palo Alto, California 94303. Shares of common stock subject to options, warrants, or other rights currently exercisable or exercisable within 60 days of September 27, 2016, are deemed to be beneficially owned and outstanding for computing the share ownership and percentage of the stockholder holding the options, warrants or other rights, but are not deemed outstanding for computing the percentage of any other stockholder.

| Name and Address of Beneficial Owner | Amount and nature of beneficial ownership | Percent of Class (1) | ||||||

| Nadir Ali | 1,591,347 | (4) | 5.7 | % | ||||

| Geoffrey I. Lilien | 1,579,241 | 5.9 | % | |||||

| Bret Osborn | 734,305 | (8) | 2.7 | % | ||||

| Leonard Oppenheim | 111,199 | (9) | * | |||||

| Thomas Steding | 64,461 | (10) | * | |||||

| Kareem Ifran | 51,516 | (11) | * | |||||

| Tanveer Khader | 2,219,534 | (6) | 8.2 | % | ||||

| Craig Harper | 160,441 | (12) | * | |||||

| Kevin Harris | 87,500 | (13) | * | |||||

| Wendy Loundermon | 385,657 | (2) | 1.4 | % | ||||

| All Directors and Executive Officers as a Group (9 persons) | 8,919,555 | (7) | 24.0 | % | ||||

| 5% Beneficial Owners | ||||||||

| SyHoldings Corporation (5) | 2,168,018 | 8.0 | % | |||||

| Abdus Salam Qureishi | 1,934,354 | (3) | 7.1 | % |

| * | less than 1% of the issued and outstanding shares of common stock. |

| (1) | Based on 26,991,983 shares outstanding on September 19, 2016. |

| (2) | Includes (i) 18,297 shares of common stock held of record by Ms. Loundermon, (ii) 345,610 shares of common stock issuable to Ms. Loundermon upon exercise of outstanding stock options, and (iii) warrants for 21,750 shares held directly by Ms. Loundermon. |

| (3) |

Includes (i) 142,754 shares of common stock held of record by Abdus Salam Qureishi, (ii) 907,288 shares of common stock held of record by the Qureishi 1998 Family Trust, (iii) 250,000 shares of common stock issuable to Mr. Qureishi upon exercise of an outstanding stock option, (iv) 154,928 shares of common stock issuable to Mr. Qureishi upon exercise of an outstanding common stock purchase warrant, (v) 182,971 shares of common stock held of record by SVI (“SVI”), (vi) 259,819 shares of common stock held of record by Cap Invest Inc. (“Cap Invest”), and (vii) 36,594 shares of common stock held of record by Naheed Qureishi, Mr. Qureishi’s wife. Mr. Qureishi is the majority stockholder of SVI and Cap Invest and may be deemed to have voting and investment control of the shares of Common Stock held by such entities. Mr. Qureishi is the sole trustee of the Qureishi 1998 Family Trust and may be deemed to have sole voting and investment control. Mr. Qureishi resigned as a director of the Company effective as of the close of business on September 30, 2016. |

| 17 |

| (4) | Includes (i) 570,413 shares of common stock held of record by Nadir Ali, (ii) 647,835 shares of common stock issuable to Nadir Ali upon exercise of an outstanding stock option, (iii) 54,892 shares of common stock held of record by Lubna Qureishi, Mr. Ali’s wife, (iv) 274,457 shares of common stock held of record by the Qureishi Ali Grandchildren Trust, and (v) 43,750 shares of common stock issuable to Lubna Qureishi upon exercise of an outstanding common stock purchase warrant. Mr. Ali is the joint-trustee (with his wife Lubna Qureishi) of the Qureishi Ali Grandchildren Trust and has voting and investment control over the shares held. |

| (5) | The power to vote and dispose of these shares is held by Mr. Tanveer Khader, 1735 Technology Drive, #430, San Jose, CA 95110. |

| (6) | Includes (i) 2,168,018 shares of common stock owned directly by SyHolding Corp., (ii) 40,000 shares of common stock held of record by Mr. Khader and (iii) 11,516 shares of common stock issuable to Tanveer Khader upon exercise of outstanding stock options. Tanveer Khader holds the power to vote and dispose of the SyHoldings Corporation shares. |

| (7) | Includes (i) 3,315,380 shares of common stock held directly, or by spouse, (ii) 3,792,553 shares of common stock held of record by entities, (iii) 1,583,694 shares of common stock issuable upon exercise of stock options, and (iv) 227,928 shares of common stock issuable upon exercise of common stock purchase warrants. |

| (8) | Includes (i) 661,006 shares of common stock held of record by Mr. Osborn and (ii) 73,299 shares of common stock issuable to Bret Osborn upon exercise of outstanding stock options. |

| (9) | Includes (i) 92,183 shares of common stock held of record by Mr. Oppenheim, (ii) 11,516 shares of common stock issuable to Leonard Oppenheim upon exercise of outstanding stock options, and (iii) warrants for 7,500 shares held directly by Mr. Oppenheim. |

| (10) | Includes (i) 40,000 shares of common stock held of record by Mr. Steding and (ii) 24,461 shares of common stock issuable to Thomas Steding upon exercise of outstanding stock options. |